Your cart is currently empty!

Tag: IPO

Hungry for growth, idli-dosa batter maker iD Fresh hunts for its next blockbuster product

“While there’s nothing like homemade batter, iD Fresh is the only one that comes close to it. The quality is consistent, and the quantity is just right—enough for two meals for two people,” she said.

Living in central Bengaluru, Swapna makes a trip to her neighbourhood department store to pick up the batter about once a month. But beyond the company’s paneer, she hasn’t explored the rest of the product range, which includes coffee decoction, parathas and chutneys.

In the crowded and fiercely competitive world of consumer food brands, iD Fresh has become a household name with its blend of innovation and nostalgia. Today, many people associate dosa batter with the company’s distinctive green and yellow packaging. But, like Swapna, they haven’t really explored the company’s other products.

Two decades after it was set up, the company still derives the majority of its revenue from idli-dosa batter despite its strong brand recognition. Relying on that one product has hampered iD Fresh’s efforts to scale up, something the founders acknowledge.

“Batter will be a ₹500-crore business for us (it is currently at about ₹300 crore), and parathas will be a ₹300 crore category for us before we go for an IPO in 2027. But I can’t depend on just two products. I need to have two-three more such products for us to scale the business,” P.C. Musthafa, co-founder and global chief executive officer, iD Fresh Foods, told Mint in a conversation at the company’s office in Bengaluru.

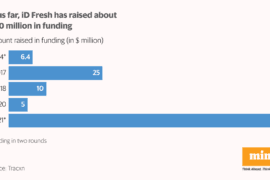

Started in 2005, the Bengaluru-based company has raised about $120 million in funding from investors, who include Helion Venture Partners, NewQuest Capital Partners and Premji Invest. It is currently valued at about $270 million.

After reporting a net loss of ₹23 crore in FY23, the Bengaluru-based company turned profitable in FY24. Over that same period, the ready-to-cook company recorded a 16% rise in its operating revenue to ₹396 crore. It is hoping to increase that number to ₹700 crore in the ongoing financial year (FY25).

iD Fresh is now looking to go past the ₹1,000 crore revenue milestone. The company has a plan to get there—but can it deliver?

Cracking the market

iD Fresh started as a modest operation in a 50-square-foot kitchen in Bengaluru when Musthafa and his cousins (Shamsudeen T.K., Abdul Nazer, Jafar T.K. and Noushad T.D.), who are co-founders of the company, identified a gap in the market for high-quality, preservative-free idli and dosa batter.

The founders, who have maintained a conservative approach from the outset, raised capital only after nearly a decade of operations. “Unlike many startups that raise capital early to scale up rapidly, we took a more sustainable approach, reinvesting revenues to fuel our growth,” Musthafa told Mint. “It was only much later, when we saw the opportunity to expand into new markets and categories, that we decided to raise external capital to support our collective vision.”

What fuelled the company’s growth was adoption by urban consumers. iD Fresh’s idli-dosa batter business is based on providing an easy-to-use alternative. “They were taking away the headache of the housewife,” said Sreedhar Prasad, former partner at KPMG and a startup advisor. “The company saw growth primarily because of adoption by migrant families.

The double-income, not-staying-with-parents element reinforced the thesis that you need a cut-and-use product, whether it is batter, chutney, or parathas.”

View Full Image

A screen grab from the iD Fresh Foods website. (Website)

Rahul Chowdhri, who was involved in Helion’s investment in the company and iD’s first institutional investment round in 2014, said the company was already a recognizable brand in Bengaluru and doing about ₹50-60 crore of business at the time of the investment. “We were interested in the ready-to-cook as opposed to ready-to-eat thesis of the company,” he said.

The distribution model—directly from the manufacturing facility to the retailer, sans any intermediaries—has also been a key driver of iD Fresh’s growth so far.

Missing the mark

Where the company has fallen short is in going deep and wide. Most of iD Fresh’s business comes from large cities. A major operational challenge that inhibited its expansion into tier II and tier III towns is the cold chain requirement of its products. Most have a short shelf life and require constant refrigeration. So, iD Fresh can only target stores that have a refrigerator, and only those that do not turn it off at night.

“If they crack this large tier II market operationally, that will be the big story,” said Prasad.

If it continues in the short-shelf life categories, it will need to figure out what more it can add to the portfolio. And if not, it needs to move aggressively to long-shelf life categories to increase the average order value of the customer, and to expand its reach to more stores and cities.

Experts point out that while the company enjoys credibility among households, it hasn’t really leveraged it to sell more to loyal customers. “I really think they missed out a few years, where they could have done much better. We have seen a lot of brands for spices, nuts, etc. built in the last three-four years,” Satish Meena, founder at Datum Intelligence, a research company, told Mint.

They possibly lost out on the business of sauces, which has grown considerably in the past three years, said Prasad. “In a span of 20 years, their flagship products are still batter and paratha. I am surprised there haven’t been more products that worked for them, selling to the same consumer,” he said.

If they crack this large tier II market operationally, that will be the big story.

—Sreedhar PrasadMusthafa, however, said the founders are not willing to dilute their value proposition. “Why do people end up adding chemicals and preservatives in the food? One, to create that artificial taste. Second, to reduce the cost, and third, to have extended shelf life. I can’t add any of those ingredients as it’s against the brand philosophy,” he explained.

The coffee decoction launched about three years ago and spices launched subsequently haven’t taken off either, Musthafa admits. “Our spices are free of pesticides and the pricing is premium so it will probably take some time for consumers to start paying for it,” he said.

As for coffee, he believes it’s the best product that has come from iD but somehow it’s not doing well in the market. And so, iD Fresh’s search continues for a product that could be its next golden goose.

Expansion in the works

The company’s growth from here on will hinge on two key expansion strategies: deepening its presence in existing geographies with new products and reaching tier II and III cities to acquire new customers. To that end, it aims to launch one product every month and double the number of cities it operates in.

iD Fresh recently launched speciality batters (it has introduced a ragi variant and plans to launch protein and other kinds of batter in this category) and bread, which the founder says are doing really well. Launched in December, ragi batter is already generating a revenue of ₹1 crore a month, says Musthafa.

The company has outlined a clear roadmap for its product strategy this year: it plans to launch tender coconut water in March, starting from Bengaluru, and then going to other metros. It also plans to launch new variants of chutneys this quarter. Moreover, it is looking at relaunching noodles, a category it experimented with in the UAE market sometime back, and snacks, the latter either in-house or through an acquisition.

Riding on new products iD hopes to maintain 25% growth over the next 10 years. Musthafa is confident that the three new product categories—speciality batter, tender coconut and stuffed paratha—will definitely give the company ₹100 crore revenue.

We are seeing an exciting response from newer geographies launched in the past year, including Ahmedabad, Goa and Jaipur.

—Kaveesh ChawlaBut that won’t be easy. Tender coconut grapples with the challenge of seasonality given that it is in demand mainly in summers, while stuffed parathas are merely an extension of an existing category rather than a novel product.

iD also intends to revamp categories that have not worked. While the company is still evaluating how to boost sales of coffee, it is looking at introducing a fresh version of spices in the form of pastes. “We believe we are good at category creation. Maybe, instead of trying to fight with the established players in the same category, it’s better for us to disrupt,” said Musthafa, noting that even if he is able to get two of the 12 products right, and scale them up, he would be successful.

The company currently operates in about 57 cities and will add 50 more this year, as part of a larger ‘Kashmir To Kanyakumari’ project to broaden its footprint.

“We are witnessing an exciting response from newer geographies launched in the past year, including Ahmedabad, Goa, and Jaipur,” Kaveesh Chawla, partner, Premji Invest, an iD investor, told Mint. “Looking back, we believe we should have expanded pan-India sooner.”

The road ahead

iD’s portfolio clearly shows its products cater to the South Indian palate. That concentration has meant it has not tapped the large North Indian market. South India, according to the company, constitutes approximately 62-64% of its business.

“Batter is a pan-India story. There’s dosa batter (in the South) then there’s chilla batter in the North. The use case they are catering to has the potential to be far larger,” said Prasad. “If the product is heavily South Indian, you will grow in South India only. They did the problem-solving for a South Indian family. Now, they should look at how they can do it for a North Indian family.”

According to Musthafa, the company is actively working to increase its presence in North India. How effectively it executes in that market will be crucial to its success.

Industry estimates peg the size of the idli-dosa batter market at approximately ₹5,000 crore and iD Fresh claims that it has a market share of around 75-80% in the cities it operates in.

Along with its existing challenges, the company now faces more competition. Nandini, a much-beloved brand in South India from Karnataka’s state-owned milk cooperative KMF, has launched its own protein idli dosa batter, threatening iD’s market share in the South. Media reports suggest its products are flying off the shelves.

Nandini has a large distribution network as well as offline stores across Karnataka to market its products. Industry estimates peg the size of the idli-dosa batter market at approximately ₹5,000 crore and iD Fresh claims that it has a market share of around 75-80% in the cities it operates in.

In markets such as Chennai, iD Fresh’s idli-dosa batter also has to contend with mom-and-pop stores that sell freshly ground batter to customers at very affordable rates. That dosa maavu, as it is known in Tamil, sells for as little as ₹30 for 1 kg, and is enough to make at least 15 dosas. In contrast, 1kg of iD’s idli-dosa batter sells for ₹79 on grocery app Big Basket, after a discount of 1%.

“Rather than solely focusing on defending our market share, we are committed to continue innovating and growing the category by delivering fresh, authentic food to our consumers,” said Musthafa. One of those innovations could see it launch whole tender coconuts with taps instead of bottling the water or packaging it in a tetrapack.

But in order to get to the next level quickly, Musthafa and his co-founders will need to find another hit product that will lift their fortunes, in much the same way that yeast makes batter rise overnight.