Your cart is currently empty!

Jio Cinema-Disney+ Hotstar merger: Why JioHotstar needs batting depth beyond the IPL

Leaning heavily on fiction and biopics, streaming platforms such as Netflix, Amazon Prime Video and SonyLIV have been keeping audiences hooked with original shows, which have grabbed viewers by the eyeballs. Netflix has also tapped its international programming, particularly the second season of the Korean hit show Squid Game, to keep viewers glued.

Unlike its competition, Disney+ Hotstar had stepped back from commissioning original programming over the past year in the runup to its impending merger with JioCinema. The latter, meanwhile, brought out some small-budget, fiction-based content. For the most part, however, it relied on sports programming, particularly the Indian Premier League (IPL) T20 cricket tournament, and to a lesser extent the reality show Bigg Boss, to build its subscriber base.

But that could change now that Disney+ Hotstar and JioCinema have come together.

Creating a behemoth

In February last year, Mukesh Ambani’s Reliance Industries Ltd (RIL) and The Walt Disney Co. formed a joint venture that they said would combine the businesses of Reliance’s associate company, Viacom18 Media Pvt. Ltd, and Disney’s Star India. Nita M. Ambani would head the Reliance-Disney joint venture as its chairperson, while broadcast industry veteran Uday Shankar would be vice-chairperson.

Following the sale of Disney’s India assets to RIL, the merger into one streaming platform, JioHotstar, was finally announced last month.

The merger combines the two companies’ media assets across the entertainment (TV channels such as Colors, Star Plus, Star Gold) and sports segments (Star Sports and Sports18). It also fuses content streaming on its over-the-top (OTT) video platforms, JioCinema and Hotstar, which together reach more than 750 million viewers across India.

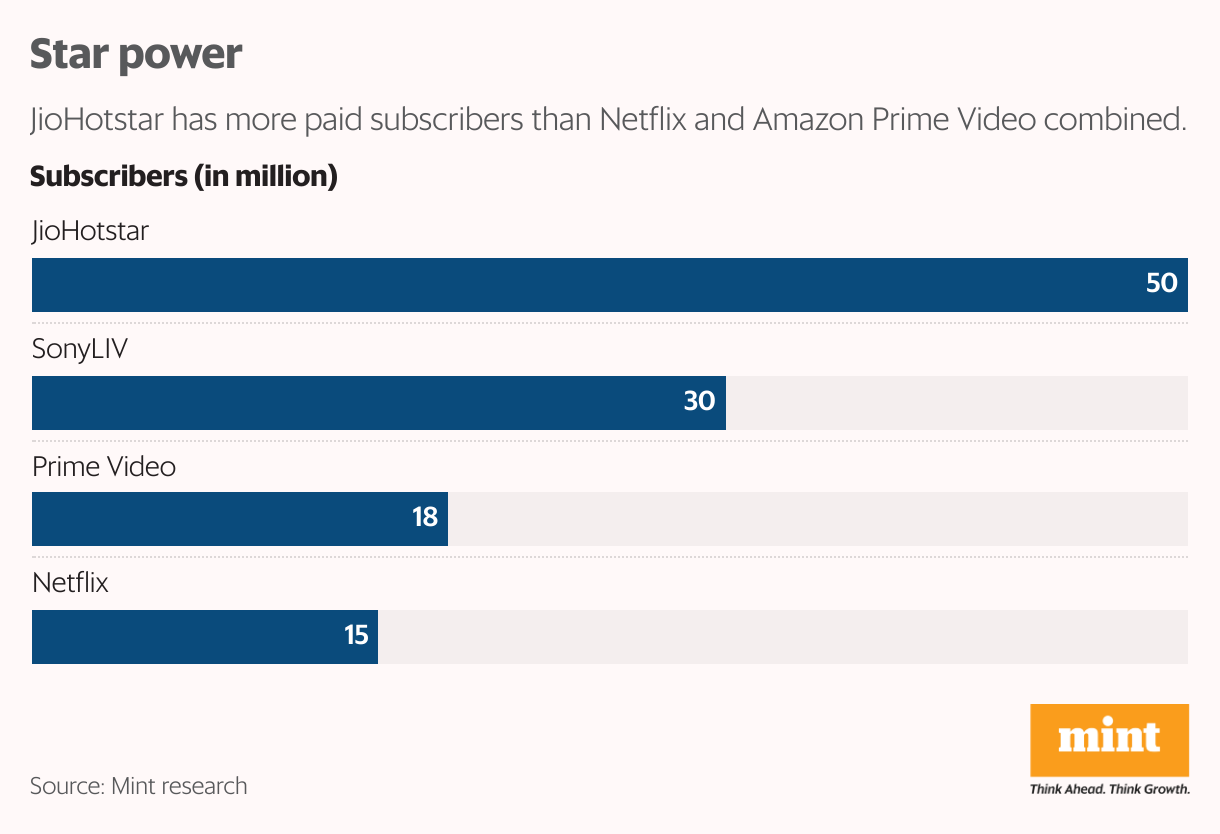

The combined Reliance-Disney streaming entity is three to four times bigger than the likes of Netflix in terms of total hours of programming and may even look at acquiring smaller, niche language-specific entities that are struggling to survive, according to industry experts. Their total paid subscriber base of 50 million is far higher than Netflix’s estimated 15 million and Prime Video’s 18 million users.

To be sure, the merger with Disney has created a combined streaming entity with great muscle. But does JioHotstar have more than the IPL, which begins next weekend, to stand out in the market?

In the runup to the cricket tourney, JioHotstar has been keeping viewers engaged by streaming the ICC Men’s Champions Trophy 2025. It has also launched and announced a bunch of local language web originals such as Kaushaljis vs Kaushal, Dil Dosti Aur Dogs and Oops Ab Kya?

“JioHotstar is not just a streaming platform… With an unparalleled mix of global, regional, and original content, we are making premium entertainment an essential, everyday experience,” the platform said in an emailed response to Mint’s queries on content strategy beyond the T20 league.

“With an ambitious content pipeline of two to three new originals every month, 40–50 southern originals annually, and curated movie premieres every quarter, we are creating a consistent and exciting entertainment experience that keeps audiences coming back for more,” it added.

While company executives have been exuding confidence, industry insiders are not so sure. Aside from sports programming and Bigg Boss, they point out that the erstwhile JioCinema had only been adding to its cluttered library by releasing shows and movies on a regular basis without any marketing or promotions or allowing for user discovery.

JioHotstar’s wider strategy, particularly for SVoD (subscription video-on-demand) viewers, may warrant some critical thought, say these industry watchers, given the challenges awaiting it in India’s cluttered OTT market.

Beyond sports

While the company has started rolling out a slate of local Indian language content and is aided by the erstwhile Disney+ Hotstar content library, the premium OTT series game in India is dominated by Netflix and Prime Video, and to a lesser extent, SonyLIV.

These platforms not only come with deep pockets and established franchises but are now over eight years into the industry, having learnt to call the shots, particularly over the past year, when Hotstar had slowed down commissioning.

According to media consulting firm Ormax Media, the third season of Mirzapur was the most-watched Hindi language original of 2024, followed by the third season of Panchayat (both shows are on Prime Video) and Heeramandi on Netflix.

Further, while both Shankar and Reliance are expected to control acquisition costs and are unlikely to pay huge amounts for theatrical movies, an Ormax report says that over 75% of the major theatrical films released between 2022 and 2024 have been acquired by either Netflix or Prime Video, making for a fairly duopolistic landscape for what is deemed an established audience draw.

Secondly, as far as international content goes, the Reliance-owned platform is at an advantage, without doubt, with the transaction giving the company access to Disney’s massive libraries across the English language, including its Marvel catalogue.

Meanwhile, Reliance already has content from HBO, Paramount and Peacock, making it a viable English language catalogue. But as many point out, there is little to beat Netflix globally when it comes to English language programming. According to Ormax, the most watched international show in India in 2024 was the second season of Squid Game, followed by Prime Video’s The Boys season 4.

That makes for an interesting challenge for JioHotstar, on multiple language fronts, in the coming months.

“No other platform comes close to our depth and diversity. The world’s largest Hollywood library is right here, with content from Disney, Warner Bros. Discovery, NBCUniversal, and Paramount, all under one roof,” the platform said. “At the same time, our homegrown slate is just as expansive, featuring regional originals, blockbuster premieres, and genre-defining hits like Kanneda, The Legend of Hanuman S6, Special Ops.”

View Full Image

As far as non-fiction and kids’ entertainment go, JioHotstar said it is home to titles such as Bigg Boss (Hindi, Tamil, Telugu, Kannada, Malayalam), Koffee with Karan, Khatron Ke Khiladi, Splitsvilla, Motu Paltu, The Bhoot Bandhus, Doraemon and Shin-chan.

As the platform put it, “JioHotstar is a destination for the entire family—catering to everyone while staying relatable to each one. With content from 100 plus JioStar TV channels and an always-on reality slate, we entertain like no other, bringing generations together.”

However, not everyone is convinced by the proposition.

“JioHotstar needs to define what it stands for. What is it here for? Right now, it’s a topsy-turvy mix and the viewer doesn’t really know what they are coming to the service and paying for. For Netflix, for example, the international library, niche as it may be, is a clear positioning,” said a senior content studio executive, declining to be named.

Viewers today are becoming increasingly demanding, the executive added, and need premium originals to be rolled out on a consistent basis to keep renewing subscriptions.

According to Ormax, while the number of apps subscribed to on average by a user stands at four in the metros, it tends to be less than three in small towns. Which means few users continue subscribing to apps that they don’t see value in, once marquee offerings (such as the IPL) are done with.

Digital advertising

Another school of thought posits that JioHotstar is not so much looking to compete with Netflix or Prime Video as taking on Meta and Google with its vast, Bharat-targeted approach, aided by advertising.

But again, analysts point out, digital advertising is yet to take off in a meaningful way for streaming players in India. First, brands have far too many options to choose from, and industry giants such as YouTube and Facebook, along with e-commerce, social media and short video platforms, are emerging as major rivals for impressions and audience attention.

According to a presentation put out this week by global media measurement and analytics company Comscore, YouTube attracted 411 million unique visitors across desktop and mobile platforms in India in December 2024, followed by MX Player (99 million), Spotify (91 million), Hotstar (89 million) and JioCinema (72 million).

According to Comscore, YouTube attracted 411 million unique visitors across desktop and mobile platforms in India in December 2024, followed by MX Player (99 million) and Spotify (91 million).

In India, digital advertising in the streaming industry is at a nascent stage, but with spending shifting rapidly from TV to digital. While there is a massive user base, effective ad rates are low. Therefore, as many emphasise, for bigger global streaming players, it might be financially prudent for the short- to mid-term to continue to rely on subscriptions over ads.

American streaming platform Netflix recently said that the markets where it offers ad-supported tiers account for 80% of its global ad spending, highlighting the challenges faced by OTT advertising in India, given that the service doesn’t offer ad-supported plans in the country.

“Advertising revenue is going to be a challenge because the market is extremely competitive and categories like e-commerce are eating into spends. Global tech platforms come with a strong database and AI-driven models, so JioHotstar will have to build that trustworthiness with advertisers in order to achieve scale,” noted Karan Taurani, senior vice president at broking firm Elara Capital.

That said, JioHotstar has partnered with global media audience measurement firm Nielsen to introduce third-party verified advertising data, starting with the upcoming IPL, in a shift towards transparency in digital ad measurement.

Additionally, the platform has introduced ‘Sparks’, an initiative spotlighting digital creators through diverse formats, which could attract brands. “Sparks is more than content—it’s a cultural shift bridging the gap between brands and creators, where we are unlocking high-impact partnerships that push creative boundaries and set new benchmarks in digital entertainment,” the platform said.

Digital voices such as Kusha Kapila, Zakir Khan, Uorfi Javed, Ranveer Brar, Manisha Rani, and Elvish Yadav will be part of the programme.

Further, the platform has been livestreaming events such as Coldplay’s Music of the Spheres concert, Mahashivratri celebrations, the Oscars and The Grammy Awards for sponsorship opportunities and better monetization.

View Full Image

“The combination of JioCinema and Hotstar has created a powerful platform, poised to accelerate the expansion of India’s premium VoD market,” said Mihir Shah, vice president, Media Partners Asia, an independent provider of research, advisory and consulting services across the media and telecoms sectors in the Asia Pacific. “This integration isn’t just about content; it’s about a data-driven user experience that opens up unprecedented opportunities for targeted advertising and personalized subscriptions.

Now, the focus shifts squarely to execution. “Success will depend on their ability to innovate with diverse content forms, leverage interactive features to deepen viewer engagement, and deliver a consistently high-quality experience across a large user base,” Shah added.

Implications for creators

That said, with the Reliance group and Shankar both known to control costs, industry insiders expect the new streaming entity to also have an impact on content creators, in general.

For one, writers and producers will have fewer options to pitch and ideate with. Plus, their bargaining power will be limited when one huge entity dominates the market and possibly decides to focus on certain themes to cater to its mass-market audience.

“The platform is definitely moving towards cost rationalization. It won’t, for example, pick up costs of Bollywood producers who would rely on OTT to help recoup their entire production budgets. Talent, too, may not be able to charge as much,” said a senior studio executive, declining to be named.

The trend will impact ATL (above-the-line) costs for sure, but may prove to be a challenge in terms of content quality. “The downside to such TV-like content is creators may not be able to maintain the same standards of production. Once budgets are compressed, and the entire model is based on RoI (return on investment), you may create something wild and exceptional here and there but that’s not going to be the norm,” the executive added. “Because you’re no longer looking to compete with Hollywood or foreign platforms—that breakout moment for Indian content globally may never happen.”

Leave a Reply