Your cart is currently empty!

Category: Crypto

“Discover the latest trends and insights in cryptocurrency. Stay updated with news on Bitcoin, blockchain technology, crypto trading tips, and market analysis to make informed investment decisions.”

5 Under-The-Radar Stocks Forecast to Deliver Double-Digit Growth in 2025

- Wall Street’s Q1 earnings season gathers momentum as the biggest names in the world get set to report their latest results.

- These five companies, spanning various sectors, are forecast to deliver double-digit growth in their profits and sales.

- Investors seeking opportunities in the current market may find these under-the-radar stocks worthy of consideration.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

As investors navigate an evolving economic landscape, investors are always on the lookout for companies with strong fundamentals that are poised for substantial earnings growth.

Below, we highlight five companies— EPAM Systems (NYSE:), Lyft (NASDAQ:), Rumble (NASDAQ:), DoubleVerify (NYSE:), and Live Oak Bancshares (NYSE:)—that analysts forecast to achieve double-digit profit and sales growth in 2025. Each company is positioned to capitalize on unique market trends, from technological disruption to shifting consumer behaviors.

Let’s examine why these stocks might deserve a spot on your watchlist.

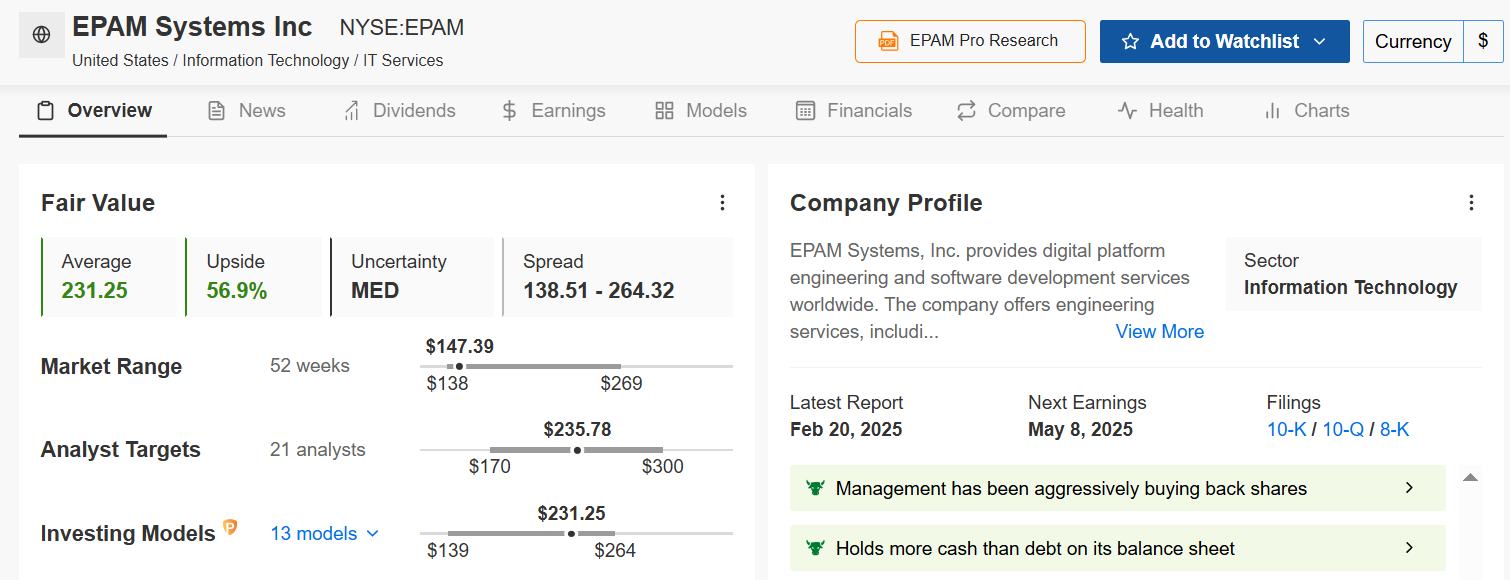

1. EPAM Systems

- Fair Value Upside: +56.9%

- Earnings Date: Thursday, May 8

- Market Cap: $8.3 Billion

EPAM Systems is a global IT services provider, offering digital transformation, software engineering, and consulting services for enterprises. Its client base spans finance, healthcare, and retail, ensuring diversified revenue streams.

This digital platform engineering and software development company is projected to deliver 38.7% EPS growth and 12% revenue growth in 2025. Its ability to provide complex, innovative solutions positions EPAM for continued growth as companies invest in their digital futures amid the current backdrop.

Source: InvestingPro

Despite recent challenges, the IT services and consulting firm’s expertise in digital transformation services and AI integration provides strong growth potential, with InvestingPro’s AI-powered models seeing a 56.9% Fair Value upside.

2. Lyft

- Fair Value Upside: +59.9%

- Earnings Date: Thursday, May 8

- Market Cap: $4.6 Billion

Lyft is a leading ride-sharing platform, providing transportation services, medical transport, and business travel solutions across North America. Innovations such as its rental car service and partnerships with bike-sharing programs position Lyft for sustained growth in urban mobility solutions.

The ridesharing company- which reported its first profitable quarter recently- has been making a remarkable turnaround, with 31.4% revenue growth in 2024 and projections for 1,885% EPS growth in 2025 alongside 12.7% revenue growth.

Source: InvestingPro

With a Fair Value upside of 59.9% as per the quantitative models in InvestingPro, Lyft’s operational improvements and market share gains are driving its impressive profit outlook.

3. Rumble

- Fair Value Upside: +1.1%

- Earnings Date: Tuesday, May 20

- Market Cap: $2.6 Billion

Rumble is a video-sharing and cloud services platform focused on free speech, competing with mainstream platforms like YouTube. Its expanding content creator base and increasing advertising revenues position it for robust financial performance.

This video-sharing platform alternative has posted 17.9% revenue growth in 2024 and is projected to achieve 104.2% EPS growth with 14.2% revenue growth in 2025 due to improved monetization and user engagement.

Source: InvestingPro

Based on the InvestingPro model, Rumble’s Fair Value is calculated at $7.64. This indicates a modest upside potential of 1.1% from current levels as Rumble scales its advertising model and cloud offerings.

4. DoubleVerify Holdings

- Fair Value Upside: +58%

- Earnings Date: Thursday, May 8

- Market Cap: $2.1 Billion

DoubleVerify specializes in digital media measurement and analytics. With the surge in online advertising, the demand for its verification services is increasing, leading to anticipated strong growth in earnings and revenue.

With projections for 198.5% EPS growth and 10% revenue growth in 2025, DoubleVerify’s technology addresses critical needs in the digital advertising ecosystem, helping brands ensure their digital ads are properly displayed and viewed.

Source: InvestingPro

InvestingPro’s Fair Value models point to a 58% potential upside as the company expands its verification services and digital advertising budgets soar.

5. Live Oak Bancshares

- Fair Value Upside: +63.5%

- Earnings Date: Wednesday, April 23

- Market Cap: $1.1 Billion

Live Oak Bancshares is a digital-first bank specializing in small business lending. The bank’s tech-driven lending platform streamlines loan approvals, making it a leader in the SBA lending space.

Analysts forecast 39.3% EPS growth and an impressive 42.5% revenue growth for 2025, driven by its scalable model and expanding customer base. The company’s expanding net interest margin and leadership stability support its positive outlook.

Source: InvestingPro

With a massive InvestingPro Fair Value upside of 63.5% and a modest P/E ratio of 16.2x, Live Oak’s blend of traditional banking and fintech innovation position it well for continued expansion.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

In Less Than 3 Years, Will Bitcoin’s Price Will Change Forever?

Bitcoin has long followed a predictable pattern driven by its halving events, which occur approximately every four years. These halving events, where the block reward for miners is halved, have historically been followed by significant Bitcoin price surges. However, as we move toward the next halving in 2028, many are questioning whether the old 4-year cycle will continue or if Bitcoin is on the cusp of a more fundamental change. In this article, we delve into the current state of Bitcoin’s market dynamics, how the 4-year cycle has shaped its history, and what the future holds for this revolutionary asset.

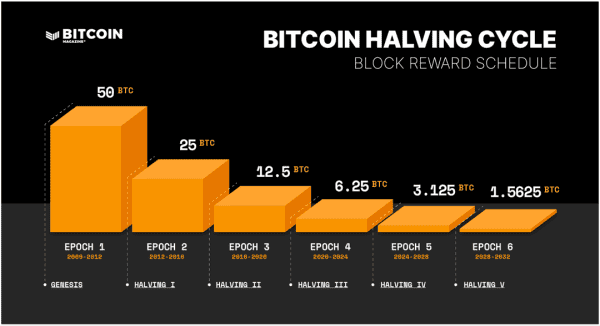

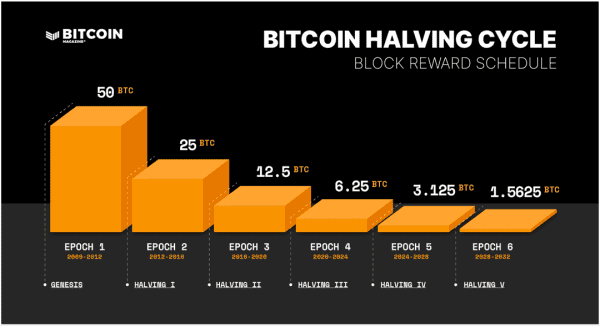

The 4-Year Cycle: The Historical Surge Pattern Of The Bitcoin Price

Halving events have been pivotal moments in its history, directly impacting the bitcoin price. Each halving reduces the block reward for miners by 50%, leading to a decrease in the issuance rate of bitcoin. The result is often a significant price increase as the reduced supply of new coins drives up demand. Historically, Bitcoin has experienced substantial price surges in the year following each halving event, albeit with some variation between cycles.

In the first halving event in 2012, the reward dropped from 50 BTC to 25 BTC per block, leading to a surge in bitcoin’s price that reached a peak in 2013. The second halving in 2016, which reduced the reward from 25 BTC to 12.5 BTC, was followed by a significant bull run, culminating in bitcoin’s meteoric rise to nearly $20,000 in December 2017. The third halving in 2020, reducing the reward to 6.25 BTC, preceded a rally that saw bitcoin’s price surpass $60,000 in 2021.

A Year After the 2024 Halving: A Softer Price Action Than Expected

However, the latest halving in April 2024 has seen a different kind of price action. While there was some positive appreciation in bitcoin’s price, the massive exponential growth that many expected has been notably absent. As of the one-year mark after the halving, bitcoin’s price has risen by about 40%, which, while positive, is far below the explosive returns seen in previous cycles, such as the 2020-2021 rally.

Historically, Bitcoin’s price has experienced a period of consolidation following each halving event, where the market adjusts to the new inflation rate. After this adjustment phase, a substantial rally usually ensues within the next 12 to 18 months. Given that bitcoin has shown some positive movement, many still anticipate the price to rise significantly in the second half of 2025, following the typical post-halving cycle.

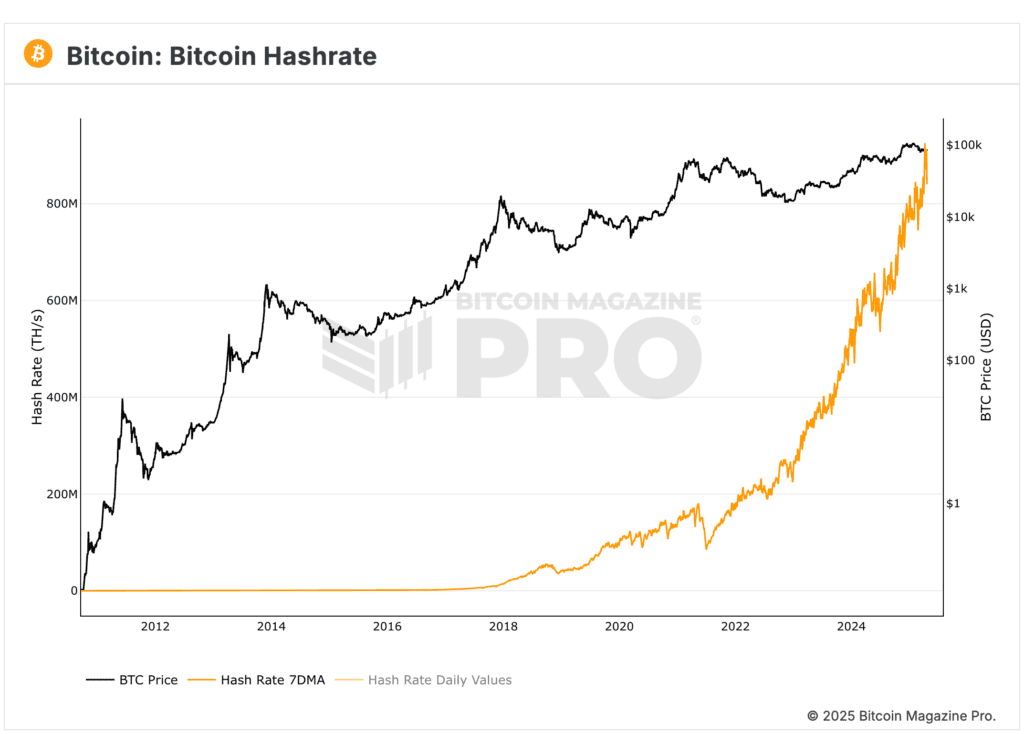

Bitcoin’s Hashrate and Miner Revenue: An Important Signal

One of the more important indicators of Bitcoin’s health post-halving is its hashrate, which refers to the total computational power of the network. Since the halving event in 2024, Bitcoin’s hashrate has continued to climb. In fact, the hashrate has surged by almost 50%, despite the reduction in miner rewards. This is a testament to the growing strength of Bitcoin’s network and the increasing competition among miners to secure the block rewards.

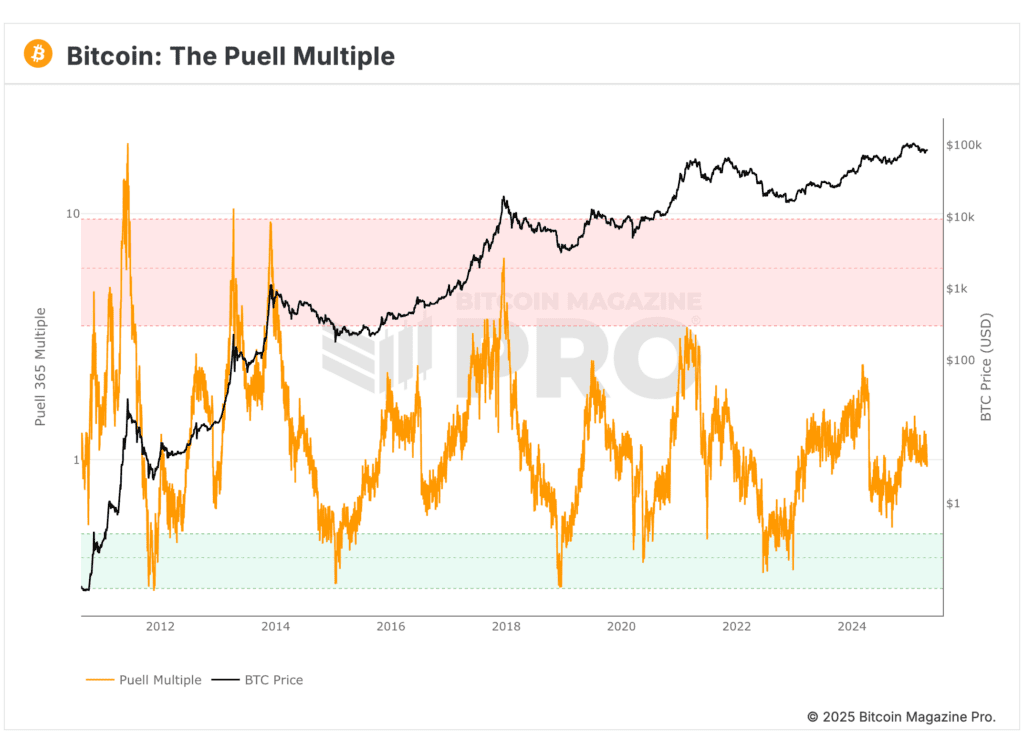

Additionally, Bitcoin’s Puell multiple, which measures miner revenue relative to the network’s price, also dropped significantly after the halving. However, it has since rebounded, signaling that the market is stabilizing and preparing for the next phase of the cycle. These indicators suggest that Bitcoin’s fundamental network strength is intact, even as the market adjusts to a lower block reward.

The End of the 4-Year Cycle: What’s Changing?

Despite the strength of Bitcoin’s network and the continued institutional interest, there are signs that the traditional 4-year halving cycle may no longer be as relevant in the future. As of now, 94.5% of Bitcoin’s total supply has already been mined, and by the time of the next halving in 2028, nearly 97% of all Bitcoin will be in circulation.

The reduced flow of new BTC into the market means that the price may no longer be as influenced by the halving events. The amount of new BTC being mined daily after the 2028 halving will be minimal—only around 225 BTC per day, a number that will barely register on daily inflows compared to current levels of tens of thousands of BTC.

As the inflation rate of Bitcoin continues to decrease, it is likely that Bitcoin’s price action will increasingly be driven by macroeconomic factors rather than the halving cycle. Institutional interest in Bitcoin has grown significantly in recent years, and this will likely continue to influence the price. Furthermore, Bitcoin’s correlation with traditional assets like the S&P 500 has strengthened, suggesting that Bitcoin’s price could begin to follow more conventional liquidity and business cycles.

The Influence of Macroeconomics: Bitcoin’s Shift Toward Traditional Business Cycles

Bitcoin’s relationship with traditional financial markets, particularly the S&P 500, has become somewhat aligned in recent years. This correlation grew significantly after the 2020 COVID-induced market downturn, as massive liquidity injections from central banks led to a sharp rise in asset prices, including bitcoin.

Looking forward, it’s likely that Bitcoin will become more aligned with global liquidity cycles and business cycles. Rather than being solely driven by the halving events, Bitcoin’s price may start to mirror broader economic trends, particularly as institutional investors become an even more dominant force in the market.

If Bitcoin follows these traditional business cycles, the role of halvings in driving price action may diminish. Instead, Bitcoin could experience more gradual price movements, influenced by factors such as the expansion and contraction of global liquidity, investor sentiment, and market cycles that are familiar to traditional assets.

The 2028 Halving and Beyond: A New Era for Bitcoin

The upcoming 2028 halving event is expected to be a crucial turning point for Bitcoin. By this point, the network will have reached nearly its maximum supply, and the block reward will be reduced to just 1.5625 BTC per block. This will mark a significant shift in Bitcoin’s inflation rate, as the amount of new bitcoin entering circulation will be minimal.

It’s likely that the 2028 halving will be the last to have a profound impact on Bitcoin’s price. After this, Bitcoin may no longer experience the traditional post-halving price surges that have characterized its history. Instead, Bitcoin’s price action will likely be driven by a combination of institutional interest, global liquidity cycles, and traditional market forces.

In Conclusion: A Changing Landscape for Bitcoin

Bitcoin’s traditional 4-year halving cycle has been a fundamental driver of its price history, but the market is evolving. As the block reward decreases and Bitcoin’s circulating supply nears its maximum, the influence of halving’s on price action will likely diminish. Instead, Bitcoin will probably follow more conventional business and liquidity cycles, similar to other major assets. This shift will be driven by the growing institutional interest in Bitcoin, its increasing correlation with traditional markets, and the evolving role of Bitcoin in the broader economic landscape.

As we look ahead to the 2028 halving and beyond, it’s clear that Bitcoin’s future should be shaped by macroeconomic trends rather than the old cycle-driven model. While this may change the way we approach Bitcoin investment and analysis, it also opens up exciting possibilities for Bitcoin’s role in the global economy.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Bitcoin-to-gold ratio risks 35% decline following Wall Street’s $13T wipeout

Bitcoin’s (BTC) value relative to gold (XAU) may be poised for a steep 35% drop as it mirrors historical bear market signals and reacts to massive turbulence that has wiped out $13 trillion from the US stock market.

Bitcoin’s breaks below key gold support

As of April 22, the BTC/XAU ratio had closed below its 50-period exponential moving average (50-period EMA; the red wave) on the two-week chart for the first time since April 2022.

BTC/XAU two-week performance chart. Source: TradingView Historically, a decisive close below the 50-period EMA has led to an extended downtrend toward the 200-period EMA (the blue wave).

For instance, in both 2021 and 2022, BTC/XAU experienced an initial bounce after testing the 50-EMA, only to eventually break below it and decline toward the 200-EMA, as shown above.

Related: Bitcoin longs cut $106M — Are Bitfinex BTC whales turning bearish above $86K?

This pattern is now repeating in 2025 after two recent tests of the 50-EMA support level in 2024 and 2025. BTC/XAU is breaking lower, suggesting that a move toward the 200-EMA may be underway, representing an approximately 35% drop.

Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, offers a similar downside outlook for the Bitcoin-to-Gold ratio, citing its extremely positive correlation with the US stock market.

Bitcoin/Gold vs. US stock market cap-to-GDP ratio. Source: Mike McGlone “What’s $13 trillion? The 2025 peak-to-trough drop in US stock market capitalization — almost 50% of GDP,” he wrote, adding:

“The Bitcoin/gold cross has same-chart symptoms with market cap-to-GDP.

“Bounces should be expected in bear markets,” he added, implying that while short-term relief rallies are possible, the prevailing trend for both Bitcoin and equities may remain downward for now.

That is in contrast to the ongoing decoupling narrative between Bitcoin and the US stocks.

BTC vs gold breakdowns are historically bearish

Weakness in the BTC/XAU pair is not just a relative signal; it often foreshadows absolute declines in Bitcoin’s price.

This trend was clearly visible during the 2021–2022 cycle. After BTC/XAU broke below its 50-EMA in late 2021, Bitcoin’s price in USD followed suit, entering a prolonged bear market that saw prices fall from over $42,000 to below $17,000.

BTC/XAU vs. BTC/USD two-week price performance chart. Source: TradingView The pattern also repeated in earlier cycles, namely the 2019-2020 and 2018-2019 periods. Each time, Bitcoin either bottomed out near its 200-week EMA or declined further below it to establish a cycle low, as shown below.

BTC/USD weekly price chart. Source: TradingView If the historical correlation between BTC/XAU and BTC/USD holds true in the current cycle, Bitcoin faces an elevated risk of declining toward its 200-week EMA by year’s end, which currently sits near $50,950.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s (BTC) value relative to Gold (XAU) may be poised for a steep 35% drop, as it mirrors historical bear market signals and reacts to massive turbulence that has wiped out $13 trillion from the US stock market.

Bitcoin’s break below key gold support signals further selloffs

As of April 22, the BTC/XAU ratio had closed below its 50-period exponential moving average (50-period EMA; the red wave) on the two-week chart for the first time since April 2022.

BTC/XAU two-week performance chart. Source: TradingView Historically, a decisive close below the 50-period EMA has led to an extended downtrend toward the 200-period EMA (the blue wave).

In both 2021 and 2022, for instance, BTC/XAU experienced an initial bounce after testing the 50-EMA, only to eventually break below it and decline toward the 200-EMA, as shown above.

This pattern is now repeating in 2025 after two recent tests of the 50-EMA support level in 2024 and 2025. BTC/XAU is breaking lower, suggesting that a move toward the 200-EMA may be underway, representing an approximately 35% drop.

Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, offers a similar downside outlook for the Bitcoin-to-Gold ratio, citing its extremely positive correlation with the US stock market.

Bitcoin/Gold vs. US stock market cap-to-GDP ratio. Source: Mike McGlone “What’s $13 trillion? The 2025 peak-to-trough drop in US stock market capitalization — almost 50% of GDP,” he wrote, adding:

“The Bitcoin/gold cross has same-chart symptoms with market cap-to-GDP.

“Bounces should be expected in bear markets,” he added, implying that while short-term relief rallies are possible, the prevailing trend for both Bitcoin and equities may remain downward for now.

Related: Bitcoin longs cut $106M — Are Bitfinex BTC whales turning bearish above $86K?

That is in contrast to the ongoing ‘decoupling’ narrative between Bitcoin and the US stocks.

BTC/XAU breakdowns are historically bearish for BTC/USD

Weakness in the BTC/XAU pair is not just a relative signal; it often foreshadows absolute declines in Bitcoin’s price.

This trend was clearly visible during the 2021–2022 cycle. After BTC/XAU broke below its 50-EMA in late 2021, Bitcoin’s price in USD followed suit, entering a prolonged bear market that saw prices fall from over $42,000 to below $17,000.

BTC/XAU vs. BTC/USD two-week price performance chart. Source: TradingView The pattern repeated in earlier cycles as well, namely the 2019-2020 and 2019-2019 periods. Each time, Bitcoin either bottomed out near its 200-week EMA or declined further below it to establish a cycle low, as shown below.

BTC/USD weekly price chart. Source: TradingView If the historical correlation between BTC/XAU and BTC/USD holds true in the current cycle, Bitcoin faces an elevated risk of declining toward its 200-week EMA by year’s end, which currently sits near $50,950.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s (BTC) value relative to Gold (XAU) may be poised for a steep 35% drop, as it mirrors historical bear market signals and reacts to massive turbulence that has wiped out $13 trillion from the US stock market.

Bitcoin’s break below key gold support signals further selloffs

As of April 22, the BTC/XAU ratio had closed below its 50-period exponential moving average (50-period EMA; the red wave) on the two-week chart for the first time since April 2022.

BTC/XAU two-week performance chart. Source: TradingView Historically, a decisive close below the 50-period EMA has led to an extended downtrend toward the 200-period EMA (the blue wave).

In both 2021 and 2022, for instance, BTC/XAU experienced an initial bounce after testing the 50-EMA, only to eventually break below it and decline toward the 200-EMA, as shown above.

This pattern is now repeating in 2025 after two recent tests of the 50-EMA support level in 2024 and 2025. BTC/XAU is breaking lower, suggesting that a move toward the 200-EMA may be underway, representing an approximately 35% drop.

Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, offers a similar downside outlook for the Bitcoin-to-Gold ratio, citing its extremely positive correlation with the US stock market.

Bitcoin/Gold vs. US stock market cap-to-GDP ratio. Source: Mike McGlone “What’s $13 trillion? The 2025 peak-to-trough drop in US stock market capitalization — almost 50% of GDP,” he wrote, adding:

“The Bitcoin/gold cross has same-chart symptoms with market cap-to-GDP.

“Bounces should be expected in bear markets,” he added, implying that while short-term relief rallies are possible, the prevailing trend for both Bitcoin and equities may remain downward for now.

Related: Bitcoin longs cut $106M — Are Bitfinex BTC whales turning bearish above $86K?

That is in contrast to the ongoing ‘decoupling’ narrative between Bitcoin and the US stocks.

BTC/XAU breakdowns are historically bearish for BTC/USD

Weakness in the BTC/XAU pair is not just a relative signal; it often foreshadows absolute declines in Bitcoin’s price.

This trend was clearly visible during the 2021–2022 cycle. After BTC/XAU broke below its 50-EMA in late 2021, Bitcoin’s price in USD followed suit, entering a prolonged bear market that saw prices fall from over $42,000 to below $17,000.

BTC/XAU vs. BTC/USD two-week price performance chart. Source: TradingView The pattern repeated in earlier cycles as well, namely the 2019-2020 and 2019-2019 periods. Each time, Bitcoin either bottomed out near its 200-week EMA or declined further below it to establish a cycle low, as shown below.

BTC/USD weekly price chart. Source: TradingView If the historical correlation between BTC/XAU and BTC/USD holds true in the current cycle, Bitcoin faces an elevated risk of declining toward its 200-week EMA by year’s end, which currently sits near $50,950.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s (BTC) value relative to Gold (XAU) may be poised for a steep 35% drop, as it mirrors historical bear market signals and reacts to massive turbulence that has wiped out $13 trillion from the US stock market.

Bitcoin’s break below key gold support signals further selloffs

As of April 22, the BTC/XAU ratio had closed below its 50-period exponential moving average (50-period EMA; the red wave) on the two-week chart for the first time since April 2022.

BTC/XAU two-week performance chart. Source: TradingView Historically, a decisive close below the 50-period EMA has led to an extended downtrend toward the 200-period EMA (the blue wave).

In both 2021 and 2022, for instance, BTC/XAU experienced an initial bounce after testing the 50-EMA, only to eventually break below it and decline toward the 200-EMA, as shown above.

This pattern is now repeating in 2025 after two recent tests of the 50-EMA support level in 2024 and 2025. BTC/XAU is breaking lower, suggesting that a move toward the 200-EMA may be underway, representing an approximately 35% drop.

Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, offers a similar downside outlook for the Bitcoin-to-Gold ratio, citing its extremely positive correlation with the US stock market.

Bitcoin/Gold vs. US stock market cap-to-GDP ratio. Source: Mike McGlone “What’s $13 trillion? The 2025 peak-to-trough drop in US stock market capitalization — almost 50% of GDP,” he wrote, adding:

“The Bitcoin/gold cross has same-chart symptoms with market cap-to-GDP.

“Bounces should be expected in bear markets,” he added, implying that while short-term relief rallies are possible, the prevailing trend for both Bitcoin and equities may remain downward for now.

Related: Bitcoin longs cut $106M — Are Bitfinex BTC whales turning bearish above $86K?

That is in contrast to the ongoing ‘decoupling’ narrative between Bitcoin and the US stocks.

BTC/XAU breakdowns are historically bearish for BTC/USD

Weakness in the BTC/XAU pair is not just a relative signal; it often foreshadows absolute declines in Bitcoin’s price.

This trend was clearly visible during the 2021–2022 cycle. After BTC/XAU broke below its 50-EMA in late 2021, Bitcoin’s price in USD followed suit, entering a prolonged bear market that saw prices fall from over $42,000 to below $17,000.

BTC/XAU vs. BTC/USD two-week price performance chart. Source: TradingView The pattern repeated in earlier cycles as well, namely the 2019-2020 and 2019-2019 periods. Each time, Bitcoin either bottomed out near its 200-week EMA or declined further below it to establish a cycle low, as shown below.

BTC/USD weekly price chart. Source: TradingView If the historical correlation between BTC/XAU and BTC/USD holds true in the current cycle, Bitcoin faces an elevated risk of declining toward its 200-week EMA by year’s end, which currently sits near $50,950.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s (BTC) value relative to Gold (XAU) may be poised for a steep 35% drop, as it mirrors historical bear market signals and reacts to massive turbulence that has wiped out $13 trillion from the US stock market.

Bitcoin’s break below key gold support signals further selloffs

As of April 22, the BTC/XAU ratio had closed below its 50-period exponential moving average (50-period EMA; the red wave) on the two-week chart for the first time since April 2022.

BTC/XAU two-week performance chart. Source: TradingView Historically, a decisive close below the 50-period EMA has led to an extended downtrend toward the 200-period EMA (the blue wave).

In both 2021 and 2022, for instance, BTC/XAU experienced an initial bounce after testing the 50-EMA, only to eventually break below it and decline toward the 200-EMA, as shown above.

This pattern is now repeating in 2025 after two recent tests of the 50-EMA support level in 2024 and 2025. BTC/XAU is breaking lower, suggesting that a move toward the 200-EMA may be underway, representing an approximately 35% drop.

Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, offers a similar downside outlook for the Bitcoin-to-Gold ratio, citing its extremely positive correlation with the US stock market.

Bitcoin/Gold vs. US stock market cap-to-GDP ratio. Source: Mike McGlone “What’s $13 trillion? The 2025 peak-to-trough drop in US stock market capitalization — almost 50% of GDP,” he wrote, adding:

“The Bitcoin/gold cross has same-chart symptoms with market cap-to-GDP.

“Bounces should be expected in bear markets,” he added, implying that while short-term relief rallies are possible, the prevailing trend for both Bitcoin and equities may remain downward for now.

Related: Bitcoin longs cut $106M — Are Bitfinex BTC whales turning bearish above $86K?

That is in contrast to the ongoing ‘decoupling’ narrative between Bitcoin and the US stocks.

BTC/XAU breakdowns are historically bearish for BTC/USD

Weakness in the BTC/XAU pair is not just a relative signal; it often foreshadows absolute declines in Bitcoin’s price.

This trend was clearly visible during the 2021–2022 cycle. After BTC/XAU broke below its 50-EMA in late 2021, Bitcoin’s price in USD followed suit, entering a prolonged bear market that saw prices fall from over $42,000 to below $17,000.

BTC/XAU vs. BTC/USD two-week price performance chart. Source: TradingView The pattern repeated in earlier cycles as well, namely the 2019-2020 and 2019-2019 periods. Each time, Bitcoin either bottomed out near its 200-week EMA or declined further below it to establish a cycle low, as shown below.

BTC/USD weekly price chart. Source: TradingView If the historical correlation between BTC/XAU and BTC/USD holds true in the current cycle, Bitcoin faces an elevated risk of declining toward its 200-week EMA by year’s end, which currently sits near $50,950.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s (BTC) value relative to Gold (XAU) may be poised for a steep 35% drop, as it mirrors historical bear market signals and reacts to massive turbulence that has wiped out $13 trillion from the US stock market.

Bitcoin’s break below key gold support signals further selloffs

As of April 22, the BTC/XAU ratio had closed below its 50-period exponential moving average (50-period EMA; the red wave) on the two-week chart for the first time since April 2022.

BTC/XAU two-week performance chart. Source: TradingView Historically, a decisive close below the 50-period EMA has led to an extended downtrend toward the 200-period EMA (the blue wave).

In both 2021 and 2022, for instance, BTC/XAU experienced an initial bounce after testing the 50-EMA, only to eventually break below it and decline toward the 200-EMA, as shown above.

This pattern is now repeating in 2025 after two recent tests of the 50-EMA support level in 2024 and 2025. BTC/XAU is breaking lower, suggesting that a move toward the 200-EMA may be underway, representing an approximately 35% drop.

Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, offers a similar downside outlook for the Bitcoin-to-Gold ratio, citing its extremely positive correlation with the US stock market.

Bitcoin/Gold vs. US stock market cap-to-GDP ratio. Source: Mike McGlone “What’s $13 trillion? The 2025 peak-to-trough drop in US stock market capitalization — almost 50% of GDP,” he wrote, adding:

“The Bitcoin/gold cross has same-chart symptoms with market cap-to-GDP.

“Bounces should be expected in bear markets,” he added, implying that while short-term relief rallies are possible, the prevailing trend for both Bitcoin and equities may remain downward for now.

Related: Bitcoin longs cut $106M — Are Bitfinex BTC whales turning bearish above $86K?

That is in contrast to the ongoing ‘decoupling’ narrative between Bitcoin and the US stocks.

BTC/XAU breakdowns are historically bearish for BTC/USD

Weakness in the BTC/XAU pair is not just a relative signal; it often foreshadows absolute declines in Bitcoin’s price.

This trend was clearly visible during the 2021–2022 cycle. After BTC/XAU broke below its 50-EMA in late 2021, Bitcoin’s price in USD followed suit, entering a prolonged bear market that saw prices fall from over $42,000 to below $17,000.

BTC/XAU vs. BTC/USD two-week price performance chart. Source: TradingView The pattern repeated in earlier cycles as well, namely the 2019-2020 and 2019-2019 periods. Each time, Bitcoin either bottomed out near its 200-week EMA or declined further below it to establish a cycle low, as shown below.

BTC/USD weekly price chart. Source: TradingView If the historical correlation between BTC/XAU and BTC/USD holds true in the current cycle, Bitcoin faces an elevated risk of declining toward its 200-week EMA by year’s end, which currently sits near $50,950.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Ethereum Bulls Target $1,800 on Staking Hopes, Fading Short Pressure

- Ethereum’s price struggles with increased selling from major institutions and falling network activity.

- Investor focus shifts towards Bitcoin as Ethereum’s value reaches a five-year low.

- Key developments, such as staking approval, could be pivotal for Ethereum’s potential recovery.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

made some recovery earlier in April, but mid-month onward, it struggled at the $1,600 level. The biggest altcoin faces challenges due to big investors selling off and low usage activity, unable to replicate positive momentum.

Institutional Selling Puts Pressure

Ethereum’s recent poor price performance is largely due to actions by big investors. Reports revealed that three key entities, including Galaxy Digital), Ethereum Foundation, and Paradigm, transferred 72,100 ETH to exchanges.

These movements suggest that selling pressure might increase among large institutions, causing unease among traders. Additionally, unfavorable on-chain data contributes as another negative factor affecting Ethereum’s value.

At the same time, Ethereum’s network health is showing concerning trends. Transaction fees decreased by 56% over the past week and 88% over the past three months. Net flows from major investors fell by 95% in the recent month.

When big investors move ETH to centralized exchanges and buying interest stays low, short-term bullish potential is weakened.

CME Futures Pressure Ends, New Catalysts Awaited

On a positive note for Ethereum, short positions on CME futures, previously a significant pressure point, have mostly been closed. These large short positions were linked to arbitrage strategies involving spot purchases on ETFs and shorting futures heading into 2025.

While this closure doesn’t directly boost prices, it does reduce downside risk, creating an environment where positive news might encourage upward movement. Some encouraging factors include increased demand for spot ETFs and the Fed possibly cutting with a more moderate approach.

Internally, the successful launch of Ethereum’s Pectra update and the SEC’s approval of staking activities for ETFs could stimulate demand. These factors may help drive interest in Ethereum.

ETH/BTC Lowest in 5 Years

Crypto investors have boosted their interest in Bitcoin this month, while Ethereum’s decline catches attention. This shift led the ETH/BTC pair to drop to 0.017, its lowest point in five years, indicating a market focus on Bitcoin as confidence in Ethereum wanes.

ETH’s value compared to BTC has been falling since 2022, putting Ethereum’s role as a leading altcoin at risk. Historically, a dropping ETH/BTC ratio often signals broader altcoin market weakness. If this trend persists, it might suggest investors are avoiding risky assets and favoring Bitcoin as a safer choice, highlighting a significant shift in the crypto landscape.

Ethereum’s ability to strengthen against the hinges on its performance relative to Bitcoin. If funds entering the crypto market begin shifting towards riskier assets over Bitcoin, Ethereum might experience a rapid dollar-based rise. The ETH/BTC pair serves as a crucial indicator in this context.

Observing the pair’s downward trend over the past year, a move towards the 0.02 level could signal a trend reversal. The nearest resistance is at 0.0186; as long as ETH/BTC stays below this point, pressure on Ethereum is likely to persist.

To reverse the long-term downward trend for Ethereum, key triggers would include the approval of staking. This could boost demand for Ethereum spot ETFs, and the implementation of updates that invigorate layer-2 networks and could improve the altcoins’ appeal.

Ethereum’s Technical Outlook

Ethereum remains in a declining channel that’s persisted for over a year. At the start of the month, buying interest emerged near the channel’s lower boundary, but the recovery stalled around the channel’s midsection, leading to sideways movement.

Currently, $1,650 is the closest resistance level for Ethereum. Short-term exponential moving averages are also acting as dynamic resistance in this area. If Ethereum’s price rises above these averages, it might signal increasing buying interest. Technically, this could lead to a move towards $1,800, aligning with the channel’s upper band. Successfully surpassing $1,800 would be a first step in reversing the trend, potentially propelling Ethereum towards $2,000 and later $2,400.

Conversely, if Ethereum fails to break past $1,650, selling pressure may increase short-term. This could trigger a new downward move, pushing Ethereum below $1,400 and possibly towards the $1,200 range.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.

Bitcoin Tax Strategies For A Runaway Fiscal Train

Lyn Alden, author of Broken Money, has made a strong case for fiscal dominance—the idea that government spending dictates monetary policy rather than the other way around. Her now-famous meme, Nothing stops this train, encapsulates the relentless trajectory of government debt and intervention. But what if something—however unlikely—could slow the train down?

Enter austerity. Not that it’s necessarily achievable in any meaningful sense, but for the first time in years, it’s being hinted at. Markets are adjusting, not because they believe it will happen, but because they’re starting to wonder if policymakers are actually serious. With the shakeup brought by Trump, Musk, and recent USAID revelations, the conversation has shifted. For the first time in a long time, there’s uncertainty around whether fiscal dominance can continue unchecked.

When a country is drowning in debt, policymakers have four main levers they can pull:

- Inflation: Quietly eroding debt (and savings) by making every dollar worth less.

- Economic Growth: Expanding the tax base and hoping for a productivity boom.

- Debt Restructuring or Default: A mix of extending, renegotiating, or outright not paying back creditors.

- Austerity: Cutting spending and increasing taxes—whether people like it or not.

For years, the austerity lever was a joke. Now? It’s at least part of the discussion – and likely part of a blended approach. And if the season of fiscal dominance continues, tax policy will be the first place where real, actionable changes show up.

For bitcoin holders, this isn’t just another macro shift to passively observe. Unlike inflation or debt restructuring—forces that are largely out of individual control—a tax policy change is one area where proactive planning can actually make a difference in your financial life. The right strategies could turn coming changes into opportunities rather than financial landmines.

Five Possible Taxation Scenarios for 2025

With fiscal dominance running the show, tax policy is in flux. The next 6-12 months will likely land in one of these five tax regimes—each with distinct implications for bitcoin holders.

1. TCJA Sunset (5% Probability)

The Tax Cuts and Jobs Act (TCJA) sunsets, and Congress does… nothing. Income taxes jump, estate tax exemptions shrink, and capital gains get more expensive. The bureaucratic equivalent of ghosting your tax bill.

2. TCJA Extension (10% Probability)

Congress extends the existing tax cuts without any new bells or whistles. A true “kick the can” move, leaving the current framework in place for a few more years.

3. TCJA Extension with Adjustments (70% Probability)

This is the base case: TCJA remains, but with modifications. Trump has hinted at eliminating taxes on tips, removing taxes on Social Security benefits, exempting overtime pay, and allowing deductions for auto loan interest on American-made cars. Additional incentives for domestic production, such as reducing the corporate tax rate and reinstating 100% bonus depreciation, could also be on the table. The possibility of reducing capital gains taxes or extending estate tax exemptions may further shape tax planning opportunities. And the grand-daddy of them all…

4. Bitcoin Capital Gains Exemption (10% Probability)

A true curveball: bitcoin gets a special status, exempting it from capital gains tax, much like gold once was. This would open up huge tax planning opportunities, from gain harvesting to retirement account repositioning.

5. The Death of the IRS (5% Probability)

We never thought we’d say it, but talk of replacing the IRS with an “External Revenue Service” has surfaced. What would that mean for enforcement? Audits? Loopholes? It’s uncharted territory, but worth watching.

Three Wild Cards That Could Shake Everything Up

Beyond these five scenarios, three unpredictable forces could upend everything—and each has significant tax implications for bitcoin holders.

1. A Liquidity Crisis and Emergency Tax Legislation

Imagine a sudden financial crisis. The government panics, money printers go brrrr, and emergency stimulus checks start flying. If the Federal Reserve intervenes aggressively, scarce assets like bitcoin could surge—making timing and tax planning for gains more important than ever.

2. A Strategic Bitcoin Reserve

What was once speculation has now become policy. A U.S. strategic bitcoin reserve has been quietly established via executive order—but so far, only as a holding, not an active accumulation strategy. The implications? The federal government now officially possesses bitcoin, a major shift in its stance toward the asset.

The key question: Will the U.S. transition from passive holder to active buyer? If so, this would mark the first time a major nation-state has become a consistent, strategic participant in bitcoin markets. A steady sovereign buyer would be a structural shift, potentially dampening bitcoin’s volatility and reinforcing its role as a macroeconomic hedge.

Would this accumulation continue even under a season of Federal Reserve balance sheet expansion? If so, it would amount to a form of money printing to acquire bitcoin—an undeniably accelerationist move. Whether accumulation begins or not, the mere presence of bitcoin on the government balance sheet alters its future tax and regulatory treatment, a factor investors must consider in long-term planning.

3. Tariff Shockwaves and Commodity Inflation

The COVID era saw multiple supply chain pricing anomalies—lumber shortages, semiconductor droughts, and food price spikes. Now imagine those disruptions revisiting in sporadic and sustained waves.

As tariffs rise and geopolitical tensions escalate, supply chains remain fragile. Shortages in key commodities could trigger rolling inflationary shocks, sending ripple effects across global markets. Bitcoin, as a scarce asset, would likely react, but with it comes new tax implications. Investors should be prepared for capital gains events resulting from price volatility, as well as potential shifts in regulatory treatment if bitcoin is increasingly viewed as a strategic reserve asset.

What Should Bitcoin Holders Do Now?

Regardless of which tax regime or wildcard plays out, here’s what you can control:

- Roth Conversions – Locking in today’s lower rates before potential hikes.

- Capital Gains/Loss Harvesting – Using market dips and tax brackets to your advantage.

- Estate Planning – Adjusting before and/or after any exemption changes hit using appropriate structures and transfers

- Income Structuring – Keeping taxable events as efficient as possible.

Expanding Tax Strategies for Bitcoin Holders

1. Roth Conversions: Securing Tax-Free Growth

A Roth conversion lets you shift assets from a traditional IRA to a Roth IRA, paying taxes now to enjoy tax-free growth later. If you expect bitcoin to skyrocket, this move locks in today’s (lower) tax rate. Convert strategically during market dips to minimize your tax bill.

2. Capital Gains Harvesting: Locking in Lower Rates

If you’re sitting on large unrealized gains, don’t wait for tax rates to rise. Selling during a year with lower taxable income could mean paying less (in some cases 0%) on long-term capital gains. Combine this with Roth conversions or other income-lowering tactics for maximum efficiency.

3. Estate Tax Planning: The Future of Bitcoin Inheritance

If estate tax exemptions shrink, handing bitcoin down could become a lot more expensive. Structuring holdings in trusts or family partnerships can help mitigate that hit. Gifting bitcoin gradually—using the annual exclusion amount—can also reduce tax exposure.

4. Income Structuring: Optimizing Your Tax Mix

To achieve the best possible tax efficiency, blending different account types—traditional IRAs, Roth IRAs, and non-retirement accounts—is key. A well-structured mix allows for tax diversification, ensuring you can strategically withdraw funds at lower tax rates in retirement. By balancing taxable, tax-deferred, and tax-free income sources, you can optimize your overall tax burden, smoothing out spikes in tax rates over time. For bitcoin holders, strategically selling from different account types based on tax brackets can make a significant impact on long-term wealth preservation.

The Next Step: Focus on What You Can Control

Rather than worrying about the powers that be and the levers they pull, focus on the ones you can control. Even if the fiscal train is out of control, you can do your best to keep your family’s wheels on the tracks. While policymakers decide which levers to pull, your tax strategy remains one of the few things you can actually control. The window to act will likely be October-December 2025—when legislation gets finalized and before new rates take effect.

Stay ahead of the storm. Book an introduction with our team of Advisors and CPAs to craft a plan that makes the most of what’s coming.

This is a guest post by Jessy Gilger, senior advisor at Sound Advisory. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

US Dollar: Trade Tensions, Fed Uncertainty Could Push Greenback Toward New Lows

- US Dollar faces heightened risks politically and economically; investors flock to safe-haven assets.

- Trump’s economic policies and Fed tensions contribute to dollar’s market volatility and depreciation.

- Persisting trade tensions and unpredictable policies accelerate shifts from dollar to other currencies.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

Recently, the has been encountering rising risks both politically and economically. The US Dollar Index reached its lowest point in three years, dropping below 98 on the week’s first trading day. This trend indicates that investors are shifting away from the dollar in favor of safe-haven assets.

Tensions Between Trump and Powell Disrupt the US Dollar

President Donald Trump’s threat of impeachment against Fed Chairman Jerome Powell played a major role in the dollar’s depreciation. Trump’s emphasis that Powell’s removal “can’t happen fast enough” is seen as not only a political message but also a challenge to the Fed’s independence. This is priced as a systemic risk by the markets.

The Fed’s decision to keep unchanged shows that it prioritizes the fight against inflation, while Trump wants a looser monetary policy to support growth. The conflict between these two different approaches increases uncertainties regarding monetary policy.

Political pressure on the Fed is having a profound impact not only on bond markets but also on FX markets. Trump’s aggressive rhetoric is undermining the dollar’s status as a “safe haven”. Investors reduced their holdings of US assets in their portfolios and accelerated their shift towards alternative currencies such as , and .

The fell from a peak of 110 after Trump’s election victory to 98 today. This decline can also be seen as evidence that Trump is moving away from the precious dollar policy. The “strong dollar” rhetoric advocated by the White House in the past has been replaced by a competitive devaluation strategy. As a result, the Trump administration has begun to move from the precious dollar to the worthless dollar phase in trade wars.

Global Trade Tensions and Volatility

Chicago Fed President Austan warned over the weekend that tariffs could have a negative impact on economic activity until the summer months, a statement that also confirmed concerns about growth.

Trump’s global trade policies also continue to put pressure on the dollar. In particular, the lack of a concrete negotiation step with China and the inconclusive negotiations with countries such as Japan increase global uncertainty.

In this environment, US multinationals have started to extend the maturities of their foreign exchange hedges. This shows that they are defending against not only short-term but also medium and long-term dollar fluctuations. While some companies have extended their hedge maturities to 2-5 years, this strengthens the comments that the perception of weakness on the dollar is not temporary and is becoming structural.

US Dollar’s Technical Outlook

The dollar started the week at 98.30, down more than 1% due to Trump’s harsh rhetoric against Fed Chairman Powell, and maintained its bearish outlook in the first hours.

The last downtrend in the dollar found support at the 100 level in the last quarter of 2024. In the ongoing process, Trump’s election as US President and the strong dollar perception helped the dollar to rise rapidly against six major currencies. However, Trump’s aggressive growth policy and global tariff plans created serious uncertainty in the short term.

Since the start of the year, the DXY has been declining steadily, recently breaking the psychological support level at 100 and continuing its sharp fall. From a technical perspective, the last upward trend concluded in the Fibonacci expansion area (between Fib 1.272 and Fib 1.618). The downward trend, which began from the 110 peak in January, is now moving towards the Fibonacci expansion area once more, reflecting the most recent rise.

In this scenario, the level of 97.5 (Fib 1.272) will be an important support to watch. If this support level is broken, the downward movement might continue and find a possible endpoint in the 94-97 range. However, if the DXY holds steady around the 97 level, there could be an increase in buying interest, potentially driving it back up toward the 100 level. Despite this possibility, the current technical indicators suggest that the bearish trend is stronger at the moment.

Trump’s Influence on Dollar’s Direction Persists

President Trump remains a key factor influencing the dollar’s direction. As the election period begins, markets are actively factoring in Trump’s economic policies and his attempts to influence the Fed. Despite this, the Fed remains committed to prioritizing price stability and combating inflation over promoting growth.

In this contentious environment, investors are distancing themselves from the dollar, focusing more on the uncertainties within the US economy, even though the Fed is inclined to maintain high interest rates. If this trend persists, the dollar may continue to weaken.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.

Now is not the time for a restaking revival

Opinion by: Alon Muroch, founder of SSV Labs

Even though Ethereum remains a leader in terms of total value locked (TVL), things aren’t looking great. Network activity is hemorrhaging, and momentum is slipping. Ethereum has become locked in a fight for its future. Without meaningful change, Ethereum risks becoming inaccessible to the builders and users it needs to thrive. Ethereum needs fresh ideas to bolster the ecosystem out of its slump, unify it, and genuinely support innovation.

Enter based applications (bApps), which are any application or service that uses the Ethereum validator set for security. Inspired by the based movement, bApps enable any project to bootstrap directly from the Ethereum layer 1 (L1), enabling interoperable, scalable and cost-effective development.

High stakes and high costs

The recent decline in network activity highlights a deep issue across Ethereum, and it boils down to UX. The race to scale a blockchain isn’t just about TVL and transactions per second (TPS). It’s about the experience of users and developers who co-create the ecosystem. Ease of development and interoperable developer ecosystems and applications are paramount. Improving the developer experience is crucial for improving user experience, which drives adoption.

Today, builders are presented with two options. The first and more popular one is restaking, which has become the default mechanism for bootstrapping new services by locking up validators’ withdrawal keys or large amounts of capital for security. That leaves teams with only one other inconvenient alternative: self-bootstrapping. Building a validator set from scratch is resource-heavy, technically complex and often starts off centralized. Both choices are limiting for builders and don’t solve the fragmentation problems we see today in Ethereum.

It is not just builders but validators that are affected by this system. In the current restaking setup, validators who want to earn more yield by supporting new services must restake, lock up their withdrawal keys, and take on additional risk. By locking up withdrawal keys to secure applications with slashable capital, validators are exposed to cascading risks, which, at scale, could affect Ethereum itself — a core departure from Ethereum’s founding vision.

bApps are more secure

bApps provide a third, more accessible option for self-bootstrapping and restaking. Using based security infrastructure drastically lowers entry barriers for any size protocol to build securely and sustainably, all while preserving the traditional network effects of Ethereum. Validators are incentivized to join through risk-free yield opportunities; developers can affordably access security to build; and users benefit from a unified and interoperable ecosystem.

Recent: SSV Network to create ‘based’ apps infrastructure for Ethereum

Mission-critical services like rollups, bridges and oracles don’t need to reinvent the wheel. They simply plug into an existing, trusted security model. Using Ethereum validators as a primary security base, any out-of-protocol service can inherit the Ethereum L1’s decentralization and Sybil resistance. It’s also possible to extend this paradigm beyond Ethereum, enabling other L1 validators to secure bApps. This potentially turns bApps into a marketplace for multichain security, dramatically reducing the complexity (and cost) for developers and raising the bar for the entire ecosystem, offering a “based” path forward.

bApps empower validators to earn more with their existing stake. By primarily using the validator principle as non-slashable security, validators can opt into many services through their existing Ethereum validator role without needing to restake or supply extra stakes. This would encourage broader validator participation, especially from smaller or more risk-averse operators, which is excellent considering solo stakers are an important ecosystem pillar.

bApps unlock scalability

bApps also revolutionize Ethereum’s current bootstrapping ecosystem, which relies heavily on slashable capital. In restaking, one participant’s gain may directly correspond to another’s loss, creating a zero-sum model. Building a competitive dynamic where participants must add or reallocate resources instead of sharing them, consequently working against new entrants by creating competition for limited attention and resources.

The based economy, conversely, promotes an infinite-sum game, transforming competition for resources into a synergistic environment where new applications, services and participants increase the overall value of the platform. Each new validator increases security for bApps, and each new bApp provides new opportunities for validators. This infinitely scalable model breaks free from the limitations of a zero-sum model, enabling seamless bootstrapping, rewarding innovation and building more secure, inclusive and resilient ecosystems.

Unifying Ethereum’s fractured ecosystem

For Ethereum to grow, fragmentation has to be addressed. Builders need building blocks, which need to be secure, low-cost, interoperable and scalable. Think about what cloud computing did for Web2. BApps offer just that — by introducing an infinite-sum game, they unlock scalability and provide a safe and affordable way to bootstrap with Ethereum’s proof-of-stake network.

If Ethereum is to be the foundation of tomorrow’s decentralized world, it must empower the builders of today. The way forward is to solve Ethereum’s user and developer experience problem with a based infrastructure. Going based is the clear solution.

Opinion by: Alon Muroch, founder of SSV Labs.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

South Korean crypto emerges from failed coup into crackdown season

South Korea kicked off 2025 with political chaos, regulatory heat and a crypto market finally brought to heel — or at least forced to grow up.

The nation closed 2024 in disarray following then-President Yoon Suk Yeol’s botched martial law stunt in December.

In the aftermath, authorities spent the first quarter drawing lines in the sand as financial watchdogs slapped cryptocurrency exchanges with probes and lifted the ban on corporate trading accounts. Meanwhile, crypto adoption hit record highs as trading volume cooled.

Here’s a breakdown of the key developments that shaped South Korea’s crypto sector in Q1 of 2025.

South Korea’s economy limped into 2025 as local currency tanked. Source: Ki Young Ju South Korean crypto traders given yet another two-year tax exemption

Jan. 1 — Crypto tax postponed

A planned 20% capital gains tax on crypto did not take effect on Jan. 1 after lawmakers agreed to delay it until 2027. This was the third postponement: first from 2022 to 2023, then again to 2025.

Related: Crypto’s debanking problem persists despite new regulations

The latest delay, reached through bipartisan consensus in late 2024, came amid mounting economic uncertainty and political turmoil. Lawmakers cited fears of investor flight to offshore exchanges, challenges in tracking wallet-based profits, and shifting national priorities in the wake of Yoon’s failed martial law stunt and subsequent impeachment.

Jan. 14 — Warning against North Korean crypto hackers

The US, Japan and South Korea published a joint statement on North Korean crypto hacks. Crypto firms were warned to guard against malware and fake IT freelancers. Lazarus Group, the state-sponsored cyber threat group, was named as a prime suspect in some of the top hacks in 2024, such as the $230-million hack on India’s WazirX and the $50-million hack against Upbit, South Korea’s largest crypto exchange.

At least $1.34 billion of crypto stolen in 2024 has been attributed to North Korea. Source: Chainalysis Jan. 15 — Companies wait on the sidelines for crypto greenlight

South Korea’s Virtual Asset Committee, a crypto policy coordination body under the Financial Services Commission (FSC), held its second meeting. The FSC was widely expected to approve corporate access to trading accounts on local exchanges. Despite popular demand, the FSC held off on making an official decision, citing the need for further review.

Instead, the FSC announced investor protections against price manipulation and stricter stablecoin oversight.

Jan. 16 — First enforcement of crypto market manipulation

South Korean authorities indicted a trader in the first pump-and-dump prosecution under the Virtual Asset User Protection Act, the new crypto law effective from July 2024.

Meanwhile, Upbit received a suspension notice for allegedly violating Know Your Customer (KYC) requirements in over 500,000 instances, prompting regulators to consider a ban on new user registrations.

Jan. 23 — Upbit, Bithumb compensate users after service outages during martial law

Upbit and rival exchange Bithumb announced plans to compensate users following service disruptions triggered by the surprise declaration of nationwide martial law on Dec. 3, 2024. The shocking move caused panic across financial and crypto markets, leading to a surge in traffic that overwhelmed local trading platforms.

Ex-President Yoon took his shot at martial law, which backfired and shaped South Korea’s 2025. Source: Kang Min Seok, Presidential Security Service South Korean crypto world finally opened to corporations

Feb. 13 — Charities and universities get first dibs on corporate crypto access

The FSC unveiled its long-awaited plan to allow corporate entities to open crypto trading accounts in phases by late 2025. The rollout will require businesses to use “real-name” accounts and comply with KYC and Anti-Money Laundering (AML) regulations. Charities and universities are first in line and will be allowed to sell their crypto donations starting in the first half of the year.

South Korea’s real-name financial transaction system, introduced in 1993, was designed to combat tax evasion and money laundering by requiring all bank accounts to be opened under verified legal names using national IDs.

Related: Market maker deals are quietly killing crypto projects

Crypto trading exploded in 2017, driven in part by anonymous accounts from businesses, foreigners and minors. Financial authorities responded by requiring crypto exchanges to partner with domestic banks and offer fiat services only through verified real-name accounts. To date, only five exchanges have met the requirements.

Since there was no regulatory framework for real-name corporate accounts, this policy effectively shut out both overseas users and domestic companies from trading on South Korean exchanges. The new roadmap aims to fix that by creating a formal structure for institutional participation under tighter compliance standards.

Feb. 21 — Alleged serial fraudster busted again

Police rearrested “Jon Bur Kim,” identified by the surname Park, for allegedly profiting 68 billion won (approximately $48 million) in a crypto scam involving the token Artube (ATT). He allegedly employed false advertising, pump-and-dump tactics and wash trading to manipulate the market.

This wasn’t Park’s first brush with the law. He was previously indicted in a 14-billion-won (around $10 million) token fraud case and was out on bail when he launched ATT.

Park flashes supercars on social media. Source: Jon Bur Kim Feb. 25 — Upbit operator Dunamu gets slapped

The nation’s Financial Intelligence Unit (FIU) formally notified Dunamu, operator of Upbit, of regulatory action. The sanctions were tied to KYC compliance failures and dealings with unregistered foreign exchanges. The FIU issued a partial business suspension, restricting Upbit from processing new customers’ deposits and withdrawals for three months.

Feb. 27 — Crypto crime force formalized

South Korean prosecutors formally launched the Virtual Asset Crime Joint Investigation Division, following a year and seven months as a temporary operation. As a non-permanent unit from July 2023, the task force indicted 74 individuals, secured 25 arrests, and recovered over 700 billion won (around $490 million) in illicit gains. The 30-person task force includes prosecutors, regulatory staff and specialists.

Feb. 28 — Upbit operator Dunamu files lawsuit to overturn business sanctions

Dunamu said it filed a lawsuit against the FIU to challenge the sanctions imposed on the exchange.

Bitcoin ETF next on checklist for South Korean crypto space

March 5 — Reconsidering Bitcoin ETF ban

The FSC started reviewing legal pathways to allow Bitcoin (BTC) spot exchange-traded funds (ETFs), citing Japan’s evolving regulatory approach as a potential model. This marks a notable shift from South Korea’s previous opposition to crypto-based ETFs.

The Capital Markets Act does not recognize cryptocurrencies as eligible underlying assets for ETFs. However, in 2024, lobbying efforts from major domestic brokerages intensified amid rising client demand, especially after spot Bitcoin ETFs were approved in the US.

While the review remains in its early stages, regulators are no longer dismissing the possibility outright.

March 21 — Crackdown on unregistered exchanges begins

The FIU compiled a list of illegal foreign exchanges and moved to block access via app stores and ISPs. Additionally, the agency warned of criminal penalties for trading platforms operating without a license.

March 26 — 17 exchange apps blocked (including KuCoin and MEXC)

Google Play removed 17 unlicensed crypto exchange apps in South Korea at the request of regulators. The FIU said it is also working with Apple to block unauthorized crypto platforms.

There are 22 unregistered overseas exchanges on the regulators’ radar, and 17 have been banned from the Google Play store. Source: FSC March 27 — Upbit scores three-month break

A South Korean court temporarily lifted the Feb. 25 partial business suspension imposed on crypto exchange Upbit by the FIU. The court’s decision allows Upbit to resume serving new users while the case is under review.

South Korean crypto expected to go from crackdown in Q1 to campaign trail in Q2

As March ended, more than 16 million investors — roughly a third of South Korea’s population — held crypto accounts, surpassing the 14.1 million domestic stock traders. But that surge in adoption came as trading activity cooled. Upbit, the country’s dominant exchange, saw volumes fall by 34%, dropping from $561.9 billion in Q4 2024 to $371 billion in Q1 2025, according to CoinGecko.

By mid-April, the crackdown was still gaining steam. Apple followed Google’s lead in removing offshore exchange apps from its store, while prosecutors filed yet another round of market manipulation charges.

South Korea’s crypto industry is now contending with tighter rules, rising institutional expectations and a government no longer content to watch from the sidelines.

All this unfolds ahead of an early presidential election in June, following Yoon’s impeachment. Crypto played a visible role in Yoon’s successful 2022 presidential election campaign and is expected to remain a key issue with voters.

One candidate in the upcoming election, former prosecutor Hong Joon-pyo of the People Power Party, recently pledged to overhaul crypto regulations in line with the pro-industry stance of the Trump administration, local media reported. Despite the pledge, Hong’s understanding of the technology came into question as he admitted to not knowing what a central bank digital currency is.

Magazine: Uni students crypto ‘grooming’ scandal, 67K scammed by fake women: Asia Express

How to use a crypto hardware wallet in 2025

TL;DR

This guide shows you how to set up and use a crypto hardware wallet, using the Trezor Safe 3 as an example. You’ll learn to safely store Bitcoin, Ethereum and other assets offline, with clear steps for wallet setup, seed phrase backup, PIN protection and secure transaction signing. The article also explains how to connect your hardware wallet to MetaMask for use with DeFi platforms and NFTs – all while keeping your private keys offline. Whether you’re comparing the best hardware wallets in 2025 or need a crypto wallet tutorial for receiving and sending funds, this guide has you covered with actionable tips and best practices for long-term cold storage security.

If you’re ready to take crypto wallet security seriously, using a hardware wallet is one of the best steps you can take.

You may already be aware of its advantages over a software wallet: keeping your private keys offline, minimizing exposure to malware and giving you full ownership of your crypto assets. Maybe you’ve even picked out your device.

The good news? While there are several options out there, from Ledger to Trezor to newer multichain hardware wallets, the basic experience is similar. This hardware wallet setup guide will walk you through unboxing, verifying the device, securing your PIN and backing up your seed phrase.

For illustration purposes, this article uses the Trezor Safe 3, an ideal device for beginners but powerful enough for advanced users. It’s also a great choice if you want to use a hardware wallet for DeFi or connect your hardware wallet to MetaMask.

Let’s get into it.

Unboxing your crypto cold wallet

Before you begin setup, here’s what comes with a typical hardware wallet, in this case, the Trezor Safe 3. This applies to most of the best hardware wallets in 2025.

What’s in the box:

First steps: Inspect and verify

Before plugging anything in, check for:

-

Sealed, undamaged packaging.

-

Intact holographic sticker over the USB port.

This ensures your device hasn’t been tampered with, a crucial crypto wallet security tip. Newer devices (post-April 2024) have upgraded seals for added air-gapped security.

If anything looks suspicious, contact Trezor support.

Power it up

Peel the sticker and connect via USB — the Safe 3 powers on automatically, and no battery or power button is needed.

You’ll notice a small screen and two physical buttons. These are how you’ll confirm actions, approve transactions and manage your crypto.

Let’s begin the setup.

Hardware wallet setup: Trezor Safe 3

Getting started takes about 10–15 minutes. For this crypto hardware wallet tutorial, just have your computer ready and a pen handy. You’ll soon need to write down something very important.

Step 1: Download Trezor Suite

Go to the official Trezor site and download the Trezor Suite app. It’s available on Windows, macOS, Linux and via web browser.

Open it, plug in your device and follow the prompts. Click “Set up my Trezor.”

Step 2: Install firmware

Your device may not come with firmware pre-installed. Click “Install Firmware.” This is part of the crypto wallet recovery process and ensures a secure, clean slate.

Step 3: Verify device authenticity

Click “Let’s check your device” in Trezor Suite. Press the right button on your Safe 3 to authenticate. You’ll see a message confirming the device is verified.

Step 4: Quick tutorial

The device might walk you through button usage. Just follow along, it’s a one-time setup.

Step 5: Create a new wallet

You’ll see two options:

-

Create new wallet (choose this if it’s your first time).

-

Recover wallet (for restoring, using your seed phrase).

Step 6: Backup method

You’ll choose between:

-

Standard seed backup (easiest and most common).

-

Shamir backup (advanced; splits the seed into parts).

Stick with standard, unless you’re sure you know what you’re doing.

Step 7: Confirm on device

Use the buttons to confirm your backup method and agree to terms. Press “Create wallet” to proceed.

Step 8: Write down your recovery seed

This is the heart of your cold storage for crypto. The device will generate a random list of 12, 20 or 24 words, your recovery seed.

Trezor will remind you not to take photos or digital notes of the seed. Write it down on the provided card and store your crypto seed phrase safely. This is critical for future recovery.

Step 9: Confirm the seed

You’ll be tested on a few of the words (e.g., “What’s word #5?”). Select the correct ones using the buttons. Once confirmed, your backup is complete.

Pro tip: Make a second copy of your seed and store it in a different secure location. This adds an extra layer of protection.

Step 10: Set up a PIN

Now, create your hardware wallet PIN. In Trezor Suite, click “Set PIN.” The device will prompt you with a randomized layout. Use the buttons to choose your digits.

PINs can be up to 50 digits long. Choose something memorable, but not obvious. If forgotten, you’ll need to wipe the wallet and recover with the seed phrase.

Step 11: Enable coins and final setup

You’ll now choose which coins to enable, Bitcoin (BTC), Ether (ETH) and more. This step also prepares your wallet for use with DApps or storing Bitcoin in a hardware wallet.

After clicking “Complete Setup,” you can name your device or customize the home screen. Then hit “Access Suite” to open your dashboard.

If you’ve been following along on your own device, you’ve just completed your first hardware wallet setup and taken a major step toward storing crypto safely!

Receiving crypto with a hardware wallet

Once your device is set up, you’re ready to store crypto safely by receiving funds into your wallet. Here’s how to accept crypto securely with your Trezor hardware wallet.

1. Open the correct account

In Trezor Suite, choose the account for the crypto you want to receive (e.g., Bitcoin #1 or Ether #1). Click the “Receive” tab to generate a crypto cold wallet address.

2. Show and confirm the address

Click “Show full address” in the app. Your Trezor will display the full address on its screen. Always confirm the address on the hardware wallet itself, not just in your browser. This ensures it hasn’t been altered by malware on your computer (a standard crypto wallet security tip).

3. Use the address

Copy the address or scan the QR code to send crypto. Your Trezor doesn’t need to stay connected; the blockchain will receive the funds and update your balance next time you plug the wallet in.

Pro tips for safe receiving:

-

Confirm addresses on your device, not just your screen.

-

Use a fresh address each time for added privacy (Trezor Suite supports this).

-

If the address doesn’t match between your wallet and app, stop immediately.

Sending crypto from a hardware wallet

Sending crypto with a hardware wallet means your private key stays offline, even while broadcasting a transaction. Here’s how to do it securely: