Your cart is currently empty!

Category: Crypto

“Discover the latest trends and insights in cryptocurrency. Stay updated with news on Bitcoin, blockchain technology, crypto trading tips, and market analysis to make informed investment decisions.”

How Coinkite Defines Cypherpunk Bitcoin Security

Advancing the standard for hardware wallet security and cypherpunk aesthetics, Coinkite, a small Bitcoin company out of Canada, is the third largest manufacturer in the industry.

Surrounded by hardware wallets that reach for mainstream adoption and seek to integrate every last altcoin in existence, Coinkite has taken a fundamentally different approach, sticking to their Bitcoin-only guns, and it’s been paying off.

“Coldcard is the ultimate HODL device — nobody else offers 10% of the features we have, and it’s all designed for Bitcoin. You literally cannot fork Coldcard for altcoins,” Rodolfo Novak, cofounder and CEO of Coinkite told Bitcoin Magazine in an exclusive interview.

“Coinkite is like a race car company or a specialty car company—a small team that makes something really, really good and has a market. Bitcoiners recognize it.”

A product of “security autism,” as he put it, Coinkite stands as one of the oldest companies in Bitcoin’s history, founded in Canada in 2013 by Rodolfo and Peter Gary.

But how did Coinkite survive for over a decade with less than 20 employees and become the third biggest manufacturer of hardware wallets, without getting into meme coins?

Cypherpunk Aesthetics

Defining the aesthetic of cypherpunk Bitcoin purism, the Coldcard devices show off their hardware behind a transparent shell, instead of hiding it. Not for show or style points, but for functional security.

“The transparent case allows users to see the hardware directly, verify that there are no external devices attached, things that might compromise the device,” Rodolfo explained. “We want people to be able to see it — it’s all functional.”

The Coldcard Q, their latest-generation device, builds on the same hardware and codebase as the older Coldcard Mk4, but adds a few new quality-of-life features like a bigger keyboard, external battery power input, independent camera module with lasers to scan even the sketchiest of QR codes, and even two micro-SD card inputs.

The device feels like a Game Boy Color console from the 2000s, but looks like it came back for revenge after surviving a throwdown with Sarah Connor.

“[Users] can easily scratch off the USB wires, to satisfy certain use cases and threat models,” added Rodolfo when explaining the depth of optionality the device offers.

Every chip, every wire, the whole architecture is observable, a choice that embodies their commitment to the “don’t trust, verify” ethos.

While it’s intimidating to look at the device at first, and the Q is generally considered a device for intermediary users, its default settings make it reasonably easy to use for anyone who is ready to take the step into hardware wallets and self-custody..

Coinkite refuses to compromise on critical security elements for user experience. For example, Coldcard Q’s large LCD screen is very simple with low power consumption, no touch screen, and a module chosen to reduce hardware complexity and keep the Coldcard an air-gapped device that can run on double AAA batteries. Coinkite also opted out of the Bluetooth standard altogether, even though it would enable new user experiences and connectivity, since it’s famously insecure.

Coinkite has no integration with anything other than Bitcoin either, avoiding the complexity and questionable security practices of many popular altcoins and also shrinking their potential customer base.

The benefits of this bitcoin-only strategy were seen recently in the Bybit hack when over a billion dollars in ETH were hacked and stolen from an exchange whose executives were using various hardware wallets, via a compromised dependency in the Safe web wallet. Executives at the exchange claim they unwittingly signed the compromised blob of hex code that represented the smart contract for their multisig, effectively blind signing away billions’ worth of the coin.

This kind of hack doesn’t happen in Bitcoin, because Bitcoin avoids that kind of complexity out of an abundance of caution. The kind of transactions that would move billions of dollars in bitcoin are far simpler and on-chain, only asking users to verify amounts, recipient addresses, and change addresses, rather than fully fledged Solidity smart contracts.

Source Available

Coinkite’s approach to transparency and verifiability goes deeper than the casing of their hardware. Their software and firmware have been open source since the beginning, going as far as to release the full schematic of their security products.

“Since version one, we always released schematics so people can go and build it themselves and prove the things. Because the whole point for us is provability. Every claim we make, we need to be able to substantiate in a way that the user can prove it themselves.”

According to Rodolfo, the devices are made of hardware that can be bought off-the-shelf, for enthusiasts and security professionals who want to leave nothing to trust.

“Some of these claims require you to be extremely advanced. But the point is somebody out there can go and prove it, right? And people do,” he added.

However, critics argue that Coldcard is not truly open source because of their licensing. The Coldcard codebase, originally released under GPL, was transferred to MIT with a commercial restriction in 2021 in reaction to a competitor who cloned their work and launched a competing device.

Rodolfo minced no words when asked about the matter; normally a mild-mannered and jolly Canadian, his passion for the topic was palpable.

“So we believe in, well, first of all, we don’t like assholes. And you can put that in the article. We’re functionally adversarial. That’s just our mindset. That’s with the code. That’s with the hardware. That’s with the law. Somebody went out there and, without mentioning to us, without anything, just took the code, didn’t even bother to change anything, contribute back, zero contributions back, and started a competing company. So we’re like, you know what, fuck you. And we changed the license.”

A rare stance in the open source ethos of the Bitcoin industry, and one which they get plenty of flak for, they are often accused of not being “open source” per se but rather “source available.”

“So we used to be GPL. And then we changed to MIT, which is even more open than GPL is. But we added a commercial clause. So anybody can copy our code, change our code, gift our code, use our code however the fuck they want. The only restriction that they have is they cannot start a competing business,” Rodolfo explained.

Critics argue that this approach limits how much review such products get, as there’s no commercial incentive to review the code, lowering the security benefits of such open-source products.

However, Rodolfo calls that a narrative. He claims that sales tripled after the event, that exchanges throughout the world use Coinkite products to secure customer funds, and that companies as well as OGs hire professionals to comb through all their code.

“There are exchanges who use our devices as part of their internal co-signing systems. There are a lot of OGs who use our devices with a lot of money in them. And we learn a lot from a lot of private conversations on attacks, on how people are using it—We get a lot of very interesting private emails with people who check the firmware every time we make an update, people who check the hardware, people who check everything.”

Forged in Chaos

Coinkite’s focus on making their devices verifiable to the core comes in part from their early roots in the Bitcoin industry.

“We wanted to do Bitcoin payments. We had the first Bitcoin payment terminal with Bitcoin debit cards and stuff like that,” Rodolfo recalled about Bitcoin and Coinkite’s infancy.

“But there weren’t any good wallets. And so we launched essentially a crypto bank for people to store funds. And then it became the multisig web wallet. I think at that time there was about $4 billion worth of bitcoin in the system. It was like 2014.”

Launching one of the first multisig wallets in the industry, the service hosted on Coinkite.com enabled users to manage multiple keys with early Trezor and Ledger hardware devices. Users could sign transactions with the kind of optionality and tooling advanced users expect from wallets today. “It was like BitGo before BitGo,” Rodolfo recalled about the web wallet that they launched in 2014 and closed down just two years later.

In a blog post at the time titled “Time To Be Your Own Bank,” Coinkite explained the reason for the closure of the web wallet, a pivot that would lead to the creation of the Coldcard:

“Being a centralized bitcoin service does attract attention from state actors and other well-funded pains in the butt, and as a matter of fact, we’ve been under DDoS since the first month we launched—over three years—yay. Plus we have put real fiat dollars into our lawyers’ pockets, to defend our customers from their own governments. This is not what we love to do, which is coding and delivering awesome services.”

This era of the Bitcoin industry was also littered with the graveyards of centralized exchanges and user-friendly web wallets. Not only were cybersecurity practices in Bitcoin a new paradigm, after all, irreversible digital money transactions had never existed before. But the regulatory uncertainty such companies faced was severe.

“We didn’t want to be in the business of holding people’s bitcoin, we wanted to empower users to hold their own keys, so we pivoted to focus on making the best hardware wallet we could.”

In 2016, Coinkite closed down the web wallet, but not before launching one of their most iconic products, the Opendime.

Challenging the limits of Bitcoin as a natively digital money, a system that requires a connection to the internet to have transactions validated by the network, the Opendime demonstrated a secure way to both lock up bitcoin value in a physical device without trust, and also allow recipients to verify its balance.The Opendime, still in use today, features a hardware seal that generates the private keys from initial user input, but in a chip that does not reveal the private key to the user — only the corresponding public key. To see the private key and spend the bitcoin sent to it, a physical seal in the device has to be broken, leaving visible evidence of device tampering and triggering a red light when plugged in rather than a green light.

The Opendime has inspired a generation of Bitcoin artists to embed these devices into physical art, such as Madex and Johnny Dollar, often adding a bitcoin balance to the device as part of the art piece.

Perhaps the most iconic device they have produced is the Blockclock. Only 500 units ever made, this “electro mechanical” time machine was made to honor the first 10 years of Bitcoin’s life.

The 500 devices sold “Quick!” Rodolfo told Bitcoin Magazine, hitting the market for 1 BTC each in late November 2018, just one month after the 10th anniversary of Satoshi’s Bitcoin White Paper release. The price of bitcoin at the time was roughly $4,000.

Demand must have been high because two smaller versions followed, clearly designed for mass consumption at much more affordable prices, the Blockclock Mini and the Blockclock Micro.

Since their founding, Coinkite has created a long list of technologies, both physical and digital, many of them open source contributions and some of them servicing critical pieces of the market. In fact, they have created so many, with dedicated websites, that when asked how many, Rodolfo laughed and basically said he had no idea.

I’ll just leave you with the biggest hits:

- BBQr — high-security QR code protocol, backwards-compatible with normie standard.

- Bitcoin Security Guide — a noob-friendly step-by-step Bitcoin self-custody guide.

- Bitcoin Treasuries — a website that tracks the biggest public holders of bitcoin.

- Bitcoin Binaries bot — a bot that automatically builds critical Bitcoin software releases from source, looking to verify that the end result is the same packaged product normal users download.

- Check MSG — a simple site that verifies the cryptography of messages signed with Bitcoin key pairs.

- NFC PushTX — a simple protocol to send Bitcoin transactions from an air-gapped device like Coldcard to a web-enabled device like a phone, and then to the web.

- Bitcoin.Review Podcast — easily one of the best Bitcoin podcasts for technical Bitcoiners, especially those that suffer from insomnia.

Emerging markets need boutique market-making to reach their full potential

Opinion by: Mārtiņš Beņķītis, co-founder and CEO of Gravity Team

As crypto adoption plateaus in some developed nations, emerging markets have led the charge for adoption. Southeast Asia, Africa and Latin America have become rapid growth centers, with new activity driven by limited banking options, local currency instability and growing smartphone use. The need for alternative finance in these regions is acute. While blockchain technology can deliver it, it certainly won’t be easy.

A significant hurdle in emerging crypto markets is market-making, where traditional approaches have struggled as a result of specific challenges, including limited infrastructure and economic instability. Standard market-making strategies often fail or are simply unable to account for these complexities. A new approach known as “boutique market-making” can unlock growth, providing tailored liquidity solutions that consider local factors like regional regulations, cultural nuance and specific pain points for each market.

This “boutique” approach will bring enormous benefits to the average person in emerging markets and, for the first time, create access to financial services and give them control over their economic outlook.

Providing liquidity in emerging markets is challenging

While the potential for growth in emerging crypto markets is clear to see, tapping into it is not. The path is fraught with challenges that require a specialized and nuanced approach. Here, standard market-making strategies are largely ineffective.

Consider trying to navigate the regulatory maze of a country where the rules keep changing and the economy is delicate and volatile. That’s the reality in Argentina. Stringent capital controls create a technical minefield for crypto transactions, requiring 24/7 monitoring and hyper-reactive strategies to ensure compliance. Why would any liquidity provider want to work with such uncertainty?

Then there’s the technological issue. Many local exchanges are built on outdated infrastructure with high latency and slippage. It’s far from the seamless APIs and lightning-fast execution of the world’s top platforms. It leads to traders and liquidity providers being discouraged from participating, resulting in thin order books, a persistent drought, and a vicious cycle of low liquidity and limited opportunity.

FX volatility further compounds the issue. Some fiat currencies experience wild fluctuations that deliver immediate conversion risks. Many local banking systems, aiming to protect their clients from this volatility, have implemented blanket bans on crypto-related transactions, causing settlement friction.

This cocktail of issues has pushed people away from centralized banking and right into the waiting arms of peer-to-peer trading, where direct transactions further fragment liquidity and make it hard for localized cryptocurrency exchanges to gain traction. These technical hurdles, however, can be overcome. They just require a contextually rich approach to market making, one that is acutely aware of every risk, issue, human need and cultural factor.

Why standardized solutions fail in emerging markets

Traditional market-making firms are used to standardized protocols, which makes it hard for them to adapt, leading to inadequate liquidity failures. This is particularly evident in regions like Argentina and Turkey, where local conditions demand bespoke solutions, despite Turkey having the highest crypto adoption rate in the world at 27.1%, followed by Argentina at 23.5%. These are well above the global crypto ownership rate estimated at 11.9%.

In Argentina, boutique firms can facilitate US dollar stablecoin flows to provide a crucial lifeline for those needing a stable alternative to the volatile peso and capital controls. Even considering this kind of service requires a deep understanding of local regulations and a proactive compliance approach.

In Turkey, price discrepancies between global and local platforms create considerable inefficiencies. Boutique market-makers stepped in to act as bridges, smoothing out inefficiencies and ensuring fairer prices for local traders.

Recent: Cryptocurrency investment should favor emerging markets

Take a look at Bolivia. Cryptocurrency was legalized in June 2024, with local crypto exchanges launching soon after but being starved of liquidity. Large firms didn’t want to touch them. Suddenly, when boutique market-makers stepped in, slippage was reduced, and prices stabilized, making trading more viable for investors of all sizes. The people won. The ability to build trust and forge lasting relationships with local communities and regulators is crucial. Hands must be shaken, and words must be kept.

Stable liquidity fuels opportunities

Boutique market makers work hard to deliver stable liquidity, in turn unlocking countless opportunities for people within emerging crypto markets. By providing consistent buy and sell orders, they reduce slippage and price volatility, creating a reliable environment for developers to build tools, platforms and decentralized applications tailored to local needs.

The stability provided by boutique market makers stems from their tailored strategies, using local knowledge, navigating regulatory mazes and bridging fragmented markets. This is unlike standardized approaches, which often falter on outdated tech or compliance hurdles. For users, this means accessible, liquid markets that support practical crypto use, from remittances to daily transactions, driving real-world adoption.

A boutique market making future

Emerging crypto markets stand at a tipping point. With their agility and local insight, boutique market-makers are the key to turning potential into action and opportunity. It’s time for stakeholders, exchanges, regulators and communities to properly rally behind these specialized players, nurturing ecosystems where innovation thrives and everyday users gain real access. The path ahead is about building a foundation for a decentralized economy that works for all. To get there, liquidity is essential.

Opinion by: Mārtiņš Beņķītis, co-founder and CEO of Gravity Team.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Can you really buy anything with Pi coin? Find out here!

Key takeaways

-

Pi coin finally went live on open mainnet in February 2025, unlocking real-world use cases after years in closed beta.

-

You can spend Pi coin, but mostly within P2P communities and KYC-verified Pi apps — mainstream adoption is still in its early stages.

-

Pi is now tradable on several CEXs, such as OKX, Bitget and MEXC, but Binance still hasn’t listed it despite 2 million+ user voters lobbying for the listing.

-

Merchant adoption is growing slowly, with real goods and services being exchanged for Pi in localized markets and app-based ecosystems.

Often described as a crypto for the people, Pi is a decentralized project that runs without the need for GPUs or gas fees. But five years since its closed mainnet launch in 2021, the million-dollar question still hangs in the air: Can you actually buy anything with Pi coin in 2025?

Let’s dive into the Pi Network’s real-world usability and answer what every Pi miner and curious crypto observer is wondering: Does Pi coin work in real life, or is it still just theoretical digital dust?

What is Pi coin, and what’s driving the attention around it in 2025?

Launched in March 2019 by a trio of Stanford Ph.D.s — Nicolas Kokkalis, Chengdiao Fan and Vincent McPhillip — the Pi Network set out to solve one of crypto’s core problems: accessibility.

Unlike Bitcoin or Ethereum, which require specialized hardware to mine, Pi coin was designed to be mined directly from a smartphone, without draining battery or data. The idea? Democratize crypto from the palm of your hand.

The Pi Network quickly went viral, spreading through invitation-only mining that created a sense of exclusivity and social virality. By 2021, the app had surpassed 20 million engaged users, or “Pioneers,” and by late 2023, that number had reportedly hit 47 million, making it one of the largest pre-mainnet crypto communities in the world.

Here’s a quick timeline of key moments:

-

March 2019: The Pi Network launches a beta version of its app on Android and iOS.

-

2020–2021: User growth accelerates through referrals; Pi phases move toward testnet.

-

December 2021: Closed mainnet goes live; Pi transactions remain within the ecosystem.

-

2022–2024: Over 100 Pi apps are built for testing in the closed economy.

-

February 2025: Pi Network officially launches its open mainnet, enabling blockchain interaction with the outside world.

This long-awaited mainnet move opened the doors for Pi (PI) coin to be listed on centralized exchanges (CEXs) and used outside its sandbox — finally bringing the project closer to its goal of becoming a real digital currency for everyday use.

From an ambitious student project to one of the most downloaded crypto apps ever, Pi Network’s journey has been anything but ordinary. But now that the tech is live and tradable, the big question is: Can you actually use Pi coin to buy things?

Did you know? Over 2 million users voted for Binance to list Pi coin — and yet, Binance has remained completely silent. Despite Pi Network boasting 47 million users and a fully launched mainnet, the world’s biggest exchange hasn’t budged. Why? Some say it’s a lack of decentralization. Others point to the controlled KYC rollout. Either way, it’s a reminder that in crypto, even a viral army can’t force the gatekeepers to open the doors.

Where can you buy Pi coin in 2025?

Following the launch of Pi Network’s open mainnet in February 2025, Pi coin has become available for trading on several cryptocurrency exchanges. As of April 2025, Pi coin is listed on the following exchanges:

-

OKX: One of the first to list PI, offering trading pairs such as PI/USDT.

-

Bitget: Provides PI trading with liquidity and user-friendly interfaces.

-

MEXC: Another early adopter, supporting PI trading pairs.

-

BitMart: Supports PI trading, though some listings may be IOUs.

-

HTX (formerly Huobi): Has listed PI, though it’s based on IOU listings.

Despite community efforts, including over 2 million votes in favor, Binance has not listed Pi coin as of April 2025. Concerns over blockchain compatibility, transparency and regulatory issues have been touted as reasons for the hesitation.

Did you know? Many Pi coin listings on exchanges are actually IOUs, which is not the real deal. These “I Owe You” tokens are speculative placeholders that aren’t backed by mainnet Pi, meaning you can’t withdraw or use them within the Pi Network ecosystem. It’s like trading a movie ticket for a film that hasn’t even premiered yet. Always check whether you’re buying the actual PI token or just a promise.

What can you actually buy with Pi coin?

Here’s where things get real (or not so real). While you might not be buying a Tesla with Pi (yet), the Pi community has been documenting purchases such as:

-

T-shirts, mugs and phone accessories

-

Freelance graphic design services

-

Basic electronics and gadgets

-

Food, drinks and small restaurant meals (in localized Pi events)

-

Handmade crafts and collectibles.

The catch? Most of these transactions happen via social media groups, Telegram chats or Pi’s own ecosystem apps such as Pi Browser and Pi Chat. These platforms act as informal marketplaces, often relying on trust and reputation rather than formal escrow systems.

So, while Pi isn’t quite ready for prime time in major retail environments, it is functioning — in a grassroots, community-driven way. Think of it more as a barter system with crypto flair than a fully integrated payment network. For now, at least.

Pi Network merchant list — fact or fiction?

If you search “Pi coin accepted stores” on Google, hoping for a list of your favorite retailers, you’ll be disappointed.

There is no official Pi Network merchant list that guarantees where Pi is accepted. Instead, adoption is grassroots and highly localized. One group of Pi Pioneers in Indonesia might be able to buy food with Pi, while another in Vietnam uses it for mobile data top-ups. But it’s hard to track, standardize or verify.

Merchant adoption is still early — but gaining traction.

Now that Pi Network’s open mainnet is live, the conversation is no longer about “if” Pi will integrate with the broader crypto ecosystem — it’s about how fast it can onboard real merchants and use cases.

One promising trend is the rise of Know Your Customer (KYC)-verified Pi apps, platforms that require users and businesses to complete identity verification before participating in the Pi economy. This layer of trust helps Pi Network build a more legitimate commercial environment, where merchants feel more confident accepting Pi coin as payment.

In the months following the open mainnet launch, Pi Network’s developers and community have focused on scaling real-world integrations, which include:

-

Local businesses in countries such as Nigeria, Vietnam, Indonesia and the Philippines accept Pi for goods and services.

-

Pi Chain Mall and other marketplaces are enabling digital commerce in Pi.

-

Third-party integrations are being tested to connect Pi with decentralized finance (DeFi) protocols, crosschain bridges and non-fungible token (NFT) platforms.

-

Pi Browser and Pi Apps allow decentralized application (DApp) developers to launch new payment-enabled services using mainnet Pi.

With over 100 Pi apps already built during the testnet phase — and a global army of KYC-verified users — Pi Network now has the tools to grow a real, scalable economy. Whether that turns into a bustling merchant network or a niche payment layer depends on what the community builds next.

With that said, there’s growing interest in onboarding merchants through KYC-verified Pi apps, hinting at a slow but potentially scalable adoption model.

Now with the open mainnet live, Pi is also expected to launch integrated DeFi protocols, decentralized exchanges (DEXs) and NFT marketplaces. If these integrations succeed, serious use cases beyond the Pi bubble could be unlocked.

Did you know? During PiFest 2025, over 1.8 million users engaged in transactions using Pi coin across 58,000 active merchants worldwide. This event showcased Pi Network’s growing real-world adoption and its potential to facilitate everyday commerce.

Is Pi coin ready for real-world payments?

Let’s be honest: Pi coin isn’t a Visa killer at the moment. It’s not ready to power global commerce or even compete with Bitcoin in El Salvador. However, it serves as a testbed for what crypto payments might look like when driven by community trust rather than institutional backing.

-

Think of it less like a universal payment tool and more like a local barter system on crypto steroids.

-

If the Pi Network nails its open mainnet rollout and expands merchant onboarding with real compliance and liquidity support, 2025 could mark the moment Pi goes from playful experiment to actual contender.

Final verdict: Can you buy stuff with Pi coin?

Yes — but with limitations.

You can spend Pi coin, but only in select peer-to-peer (P2P) markets, community-driven stores or pilot programs run by Pi Pioneers. Most of it is still happening in closed circuits, with no large-scale merchant integration yet.

But is that really a problem?

Maybe not. After all, the early days of Bitcoin weren’t much different — experimental, niche and often dismissed.

Back then, buying a pizza with Bitcoin (BTC) was groundbreaking. Now, BTC sits in exchange-traded fund (ETF) portfolios and corporate treasuries.

Whether Pi Network breaks through or fades into obscurity depends on what happens next: regulatory clarity and whether the network can scale beyond its internal community.

Believer or skeptic, one thing’s certain: The real-world test of the Pi Network economy is just getting started — and the world is watching.

-

The Inverse Of Clown World”

Bitcoin: The Inverse of Clown World by Knut Svanholm and Luke de Wolf, Lemniscate Media, 175 pages, $25.00.

This is a book review from The Mining Issue of Bitcoin Magazine Print. Get your copy here.

—

There is a similarity across the Bitcoin books published this [last] summer: They’re all about self-improvement and spiritual development. As a community, we seem to have moved on from writing about what money is, what it used to be, or how it operates in the modern world — or the specific ways in which bitcoin differs.

Instead, we’re now writing and thinking about life with bitcoin. Bitcoin has a culture, its virtues and values push its users in certain directions. [Aleks] Svetski writes about classical virtues and how they let us live well on a bitcoin standard. Mekhail writes about how to raise kids with intention and a long-term, orange, focus. In Bitcoin: The Inverse of Clown World, Knut Svanholm and his podcast sidekick Luke de Wolf gives us “a journey of introspection and self-improvement” (page 11). This “is a book about you” (page 13); not that different from how [George] Mekhail thinks about parenting.

It’s an unbelievably entertaining and powerful book, with plenty of food for thought about the insanities of our world. The chapter headings are slick, the chapters themselves digestible and relatable. If a measure of a book is how often I laugh, pull out my highlighter, or incessantly send quotes to friends, then Inverse of Clown World receives excellent marks. It’s the perfect combination of light, relaxed reading and hard-hitting punch — sprinkled with a whole jar of humor.

The allure of Inverse is to see that all the madness in the world — political grandstanding, gender dysphoria, the broad moral, fiscal, and political decay — call out for an explanation. Why is it happening? How did it come to this? It seems so obviously irrelevant and so obviously stupid.

Svanholm and de Wolf have an answer, which “is more straightforward than you might think. When the money stops working, everything becomes political and a farce” (page 51). Shockingly, the book’s main suggestion is that moral and political collapse is downstream of the money.

Hurling us straight off the deep end, the opening chapter is praxeology — that arcane, philosophical foundation for all Austrian economics. We then venture from the highest echelons of academic economics and mathematics to popular culture interpretations of Christopher Nolan’s The Dark Knight, to observations of reciprocal altruism in nature and its counterpart in human internet affairs. High and low, indeed.

Some dozen pages in, it feels like reading a textbook-like description of markets and the stylized economic hypothetical known as the prisoner’s dilemma. The authors draw important conclusions from the modern debate about that game-theoretical exercise: “[economist Robert] Axelrod’s findings emphasized the importance of being friendly and forgiving, but also appropriately retaliatory” (page 19). “The balance between self-interest and cooperative behavior is crucial in the game of life, where decisions shape futures” (page 21).

What that has to do with Clown World is a little unclear, and indeed we must wait some fifty pages to get an inkling of what precisely the authors mean by the label. Then again, if you’ve read Svanholm before or listened to the Bitcoin Infinity Show at all — or, you know, not been cave-bound for the last decade-plus — you have a pretty good idea.

Several descriptions are broad-stroke, which is understandable when you try to capture something roughly meaning “everything stupid”. It’s the desire for free lunches (page 41). It’s where “pleasing bureaucrats becomes increasingly profitable, while providing as much value as possible to your fellow man becomes increasingly futile” (page 50). Clown World directly follows from a political money, “which makes people focus on totally arbitrary issues” (page 65); indeed, most so-called societal problems aren’t even problems. Clown World is equality-focused (page 101). In contrast, Bitcoin is fair, honest, and meritocratic. At the very end of the book, we learn that “Clown World is a byproduct of people not taking responsibility”. From that definition it quickly follows, via self-reflection and better “mental software”, that “Taking responsibility for your actions is the only thing that can make the whole damn circus disappear” (page 163):

”Success in the Bitcoin world comes from providing value to your fellow human beings, not mass theft or political manipulation. Everything Divided by 21 Million equals the inverse of Clown World.”

There is no doubt in my mind that Clown World is indeed disappearing, pulling away its most ardent proponents and last, bitter beneficiaries kicking and screaming. Messrs Svanholm and de Wolf think something similar:

”things such as Bitcoin ATMs will look as ridiculous as phone booths in the not-too-distant future. […] it’s not only the ATMs that will fall into obsolescence. Everything in the Jurassic fiat currency world is on the brink of extinction. Are you a dinosaur or a human being?”

Between the ridiculing of wokeness and climate change worries, we get plenty of advice about screening out noise and guarding one’s time and mind. We get personal chapters about Knut running through the rainy slush of Gothenburg, Sweden, as well as unbelievably lengthy adventures in the Einsteinian spacetime and astrophysics. The far-fetched relevance to Clown World (“our attention also shapes our realities”, page 113) could have been reached without this much extravagance.

We get musings on creativity, stoicism, and what the relationship is between freedom and responsibility. Indeed, “whatever small step you take to increase your personal freedom footprint increases the total level of freedom dioxide in the atmosphere” (page 133).

Why should you read this book at all? It’s simple, really: It’s Knut, it’s funny, and at times it’s pretty inspiring.

Selected quotes:

- “When people know enough about Bitcoin to have stopped worrying about their financial future, they usually care less about how others perceive their words and actions and more about honesty and integrity” (page 53).

- “In a world where correct pronoun assignments, teenaged weather activists, the big game last night, Taylor Swift’s latest boyfriend, and a mostly harmless flu are headline news, it’s easy to see that some force is trying to avert our eyes from the men behind the curtain” (pages 24-25)

- “Clownish political ideas have existed for as long as politics itself. They come in many ways, shapes, and forms, and it can be hard to see their ridiculousness when living among them” (page 36)

Final nugget:

“You’re an absolute winner if you have one more Satoshi this year than last. Zoom out and be patient. Sell your chairs, slay your heroes, and take responsibility for your actions” (page 63).

Disclaimer: Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto’s debanking problem persists despite new regulations

The crypto industry’s inability to access banking services still concerns many industry observers despite recent policy victories.

In past years, financial services firms and banks concerned about fiduciary risk, reporting liabilities and reputational risk often would refuse to offer service to crypto firms — i.e., “debanking” them.

Legislative efforts in the United States and Australia are attempting to remove these barriers for the crypto industry. In the former, legislators repealed guidelines that made it difficult for banks to custody crypto assets, as well as those stating that crypto carried “reputational risk” for banks. In the latter, the Labor Party has introduced a bill to create a legal framework for crypto, giving banks the clarity they need to interact with the crypto industry.

Despite these tangible efforts, some crypto industry observers say that the crypto’s debanking problem is far from over.

US crypto execs say debanking is still an issue

The crypto industry has long decried “Operation Chokepoint 2.0,” its nickname for a suite of policies that they claim constrained the crypto industry from growing under the administration of former President Joe Biden. Among these were measures making it more difficult for crypto firms to access banking services.

The early days of the second administration of President Donald Trump have seen many of these repealed or changed. One of the first was the repeal of Staff Accounting Bulletin 121, which required banks offering custody for customers’ cryptocurrencies to list them as liabilities on their balance sheets — this made it very difficult for banks to justify offering such services.

The administration also appointed a new head of the Office of the Comptroller of the Currency (OCC), Rodney Hood. Dennis Porter, CEO of the Bitcoin-focused policy organization Satoshi Action, told Cointelegraph that under Hood’s tenure, the OCC has already said banks can offer crypto-related services like custody, stablecoin reserves and blockchain participation.

Related: Atkins becomes next SEC chair: What’s next for the crypto industry

“This opens the door for broader adoption of digital asset technology and custodial services by traditional financial institutions, signaling a major shift in how banks engage with crypto,” he said.

Despite these victories, Caitlin Long, founder and CEO of Custodia Bank, said on March 21 that debanking is likely to remain a problem for crypto firms into 2026.

Long said the non-partisan board of governors of the Federal Reserve is “still controlled by Democrats,” alluding to Democrats’ more skeptical stance on crypto. Long claimed that “there are two crypto-friendly banks under examination by the Fed right now, and an army of examiners was sent into these banks, including the examiners from Washington, a literal army just smothering the banks.”

Long noted that Trump won’t be able to appoint a new Fed governor until January, meaning that, while other agencies may be more crypto-friendly, there are still roadblocks.

Australia’s Labor Party to create crypto framework

Stand With Crypto, the “grassroots” crypto advocacy organization started by Coinbase that has spread to the US, UK, Canada and Australia, said that “in Australia, debanking is quietly shutting out innovators and entrepreneurs — particularly in the crypto and blockchain space.”

In a post on X, the organization claimed that debanking results in “reputational damage, loss of revenue, increased operational costs, and inability to launch or sustain services.” It also claimed that it forces some companies to move offshore.

In response to these concerns, the ruling center-left Labor Party in Australia has proposed a new set of laws for the cryptocurrency industry. The changes to current financial services law seek to tackle the issue of debanking in the country’s cryptocurrency industry.

Australia’s Treasury says its new crypto regulations have four priorities. Source: Australian Department of the Treasury

Edward Carroll, head of global markets and corporate finance at MHC Digital Group — an Australian crypto platform — told Cointelegraph that in Australia, debanking decisions were “not the result of regulatory directives.”

“Rather, they appear to stem from a more general sense of risk aversion due to the current lack of a clear regulatory framework.”

Related: US gov’t actions give clue about upcoming crypto regulation

Carroll was optimistic about the Labor Party’s proactive stance. The major political parties were “showing a shift in sentiment and a shared commitment to establishing formal crypto regulation.”

“We are hopeful that this will give banks the confidence to reengage with crypto businesses that meet compliance standards,” he said.

Canada unlikely to relieve crypto firms

In Canada, “debanking remains a serious and ongoing challenge for the Canadian crypto industry,” according to Morva Rohani, executive director of the Canadian Web3 Council.

“While some firms have successfully established relationships with banking partners, many continue to face account closures or denials with little explanation or recourse,” she told Cointelegraph.

While debanking actions aren’t explicit, financial institutions’ interpretation of Anti-Money Laundering and Know Your Customer regulations “creates a risk-averse environment where banks weigh compliance and reputational concerns against the relatively low revenue potential of crypto clients.”

The end result, per Rohani, is a systemic debanking problem for the digital assets industry.

But unlike in the US and Australia, the Canadian crypto industry may not find relief anytime soon. Prime Minister Mark Carney, whose more crypto-skeptic Liberal Party is surging in the polls ahead of the April 28 snap elections, is himself a crypto-skeptic.

Polls show Carney firmly in the lead. Source: Ipsos

Carney has stated that the future of money lies more in a “central bank stablecoin,” otherwise referred to as a central bank digital currency.

Rohani said that “no comprehensive legislative solution has been implemented” with regard to debanking. “A more structured approach, including mandated disclosure of reasons for account termination and regulatory oversight, is needed,” she said.

Critics claim crypto is “hijacking” the debanking issue

There is another side to the debanking debate, which claims that crypto’s debanking “problem” is a non-issue or a vehicle for crypto firms to get what they want in terms of regulation.

Molly White, the author of Web3 Is Going Just Great and the “Citation Needed” newsletter, has noted that, in the US at least, crypto firms have claimed to be victims of debanking while lauding Trump’s efforts to end protections for debanking at the same time.

In a Feb. 14 post, White stated that the crypto industry had “hijacked” the discussion around debanking, which contains legitimate concerns regarding access to financial services — particularly regarding discrimination due to race, religious identity or industry affiliation.

She claims the crypto industry has used debanking as a means to deflect legitimate regulatory inquiries into crypto companies’ compliance efforts.

Further of note is the fact that Coinbase CEO Brian Armstrong has applauded the efforts of the Department of Government Efficiency (DOGE), with Elon Musk at the helm, to dismantle the Consumer Financial Protection Bureau (CFPB).

One of the CFPB’s responsibilities is to investigate claims of debanking. But when DOGE instructed the agency to halt all work, Armstrong said it was “100% the right call,” in addition to making dubious claims about the agency’s constitutionality.

In the meantime

Whether the industry’s debanking concerns stem from legitimate discrimination or an attempt at regulatory capture, crypto firms are developing solutions in the interim.

Porter said that, as an alternative to banking services, “many crypto companies have leaned on stablecoins as a primary tool for managing finances,” while others have worked with “smaller regional banks or specialized trust companies open to digital assets.”

Rohani said that this kind of “patchwork of relationships” can increase operational costs and risks and are “not sustainable long-term solutions for growth or to build a competitive, regulated industry.”

Porter concluded that the banking workarounds could actually strengthen the industry’s position, stating that they may “continue evolving into fully integrated relationships with traditional financial institutions, further cementing crypto’s place in mainstream finance.”

Magazine: UK’s Orwellian AI murder prediction system, will AI take your job? AI Eye

4 Altcoins Attempting to Escape Bears’ Grip as Tariff Turmoil Eases

- Cryptos rebound with Bitcoin, Ethereum surging as tariff delay bolsters market confidence.

- Ethereum nears breakout at $1,720 EMA with SEC, Pectra updates as potential catalysts.

- XRP tests $2.25 resistance; Ripple lawsuit outcome crucial for upward trajectory.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The recent uncertainty caused by global trade wars has reduced risk appetite and deeply affected the cryptocurrency market. The total cryptocurrency market capitalization fell as low as November 2024 levels in the first week of April, giving back all the gains made by the Trump rally.

In the process, gained as much as 15% on a move towards $85,000 after testing below $75,000. Among the altcoins with large market capitalization, recovered close to 20%, 15%, and 30%.

However, given the bearish trend since December, the current rebound does not yet signal a clear trend reversal. Nevertheless, technically critical levels have been reached, and the possibility of a new directional breakout is strengthening.

Cryptocurrencies started to recover after US President Donald Trump announced a 90-day delay on tariffs. This helped ease market pressure and boosted investor confidence. News over the weekend about possible tax exemptions for the tech sector also lifted the mood. However, there is still a lot of confusion and mixed information about this.

At this point, although uncertainty about tariffs continues, the fact that the markets have largely priced in these developments and the lack of new negative news may create an opportunity for a short-term recovery.

Ethereum Gains Support

Ethereum continues to move by maintaining the falling channel pattern. Finally, with the purchases coming from the average level of $ 1,420, which corresponds to the lower band of the channel, ETH rose to $ 1,600. However, the recovery has slowed down in the middle band of the channel.

In order for the recovery to continue, the 21-day EMA (average $ 1,720) level corresponding to the middle band is critical. Daily closes above this level could be an important signal for the trend to break to the upside. In this case, with a test of the $1,900 level and an upside breach of the channel, it may be possible for ETH to head towards the $2,200-2,400 band.

On the other hand, selling pressure at the $1,700 level could push ETH back to lows below $1,400. Two important developments may affect the Ethereum market in the coming period: The postponement of the Pectra update and the SEC’s postponement of the staking decision for Ethereum ETFs until June. If successful, these developments could be important catalysts for ETH.

XRP Stuck at Critical Thresholds

XRP has climbed back to the $2 level after falling as low as $1.62 in recent days. However, the rise is limited at the resistance of $ 2.15. Currently, $ 2.11 stands out as support and $ 2.25 as resistance.

XRP has climbed back to the $2 level after falling as low as $1.62 in recent days. However, the rise is limited at the resistance of $ 2.15. Currently, $ 2.11 stands out as support and $ 2.25 as resistance.The persistence of the XRP price above $ 2.25 may technically bring the $ 2.36-2.50-2.75 targets to the agenda, respectively. Otherwise, the $2 level will act as a critical support. If this point is broken, the price may fall back to the $ 1.60-1.80 band and then to $ 1.15.

If the deal is formalized in Ripple’s ongoing lawsuit with the SEC, it could be a significant upside trigger for XRP. However, uncertainty remains and possible selling pressure is still on the table.

Price Squeezes on BNB

BNB Although it tested below $550 in the first quarter of the year, support was maintained with purchases from this region. Technically, this level is still the critical lower limit. However, the downward trend continued with lower peak formations in the rises.

The last recovery seems to have slowed down in the $585-590 band. Exceeding this region and crossing the $ 615 level may be the beginning of an upward trend in the short term. Otherwise, the price is likely to head towards $550 again and fluctuate within the triangle formation range. This movement should be carefully monitored as it approaches the pattern’s boundary levels.

SOL Completes the Double Top Pattern

SOL completed the $260 double top pattern it formed in November and January, falling to $100 in February. In this process, the neckline at $ 180 was broken and the target fell to the levels required by the pattern.

SOL completed the $260 double top pattern it formed in November and January, falling to $100 in February. In this process, the neckline at $ 180 was broken and the target fell to the levels required by the pattern.While the recovery process started with reaction purchases from $ 100, the cryptocurrency finally gave a signal of strength by breaking the $ 125 resistance. This level is now being monitored as the closest support. Above, the $140 level stands out as a critical resistance zone.

If $140 is exceeded, the $160-180-200 levels could be potential targets. However, if the $ 125 support is broken, there will be a risk of sagging below $ 100.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.

Price analysis 4/14: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LEO

Bitcoin (BTC) bulls are trying to start the week on a positive note by pushing the price above $85,000. Michael Saylor’s Strategy has used the recent dip to buy 3,459 Bitcoin for $285.5 million at an average price of $82,618. That boosts the total holding of the firm to 531,644 Bitcoin purchased at an average price of $67,556.

However, not everyone is bullish in the near term. Several institutional investors seem to have trimmed their holdings. CoinShares reported on April 14 that digital asset exchange-traded products (ETPs) witnessed $795 million in outflows last week. The $7.2 billion in outflows since February have reversed nearly all year-to-date inflows, now at just $165 million.

Daily cryptocurrency market performance. Source: Coin360

Although Bitcoin seems to have bottomed out in the short term, a roaring bull market rally is unlikely to start in a hurry. The tariff headlines and the outcome of the tariff talks between the United States and other countries could dictate the price action.

Could Bitcoin build upon the recovery, pulling altcoins higher? Let’s analyze the charts to find out.

S&P 500 Index price analysis

The S&P 500 Index (SPX) witnessed a hugely volatile week, but a positive sign is that lower levels attracted solid buying by the bulls.

SPX daily chart. Source: Cointelegraph/TradingView

After the massive volatility of the past few days, the index could enter a quieter phase. Sellers are likely to sell the rallies near 5,500, while the bulls are expected to buy the dips to the 5,119 support. That signals a possible range-bound action between 5,500 and 5,119 for some time.

The next trending move is expected to begin after buyers push the price above 5,500 or sink below 4,950. If the 5,500 level gets taken out, the index could surge to 5,800.

US Dollar Index price analysis

The US Dollar Index (DXY) has been in a freefall since turning down from the 20-day exponential moving average (102.81) on April 10.

DXY daily chart. Source: Cointelegraph/TradingView

Buyers defended the 99.57 level on a closing basis on April 11, but the bears renewed their selling on April 14. If the price closes below 99.57, the index could tumble to 97.50 and, after that, to 95. The longer the price remains below 99.57, the greater the risk of starting a new downtrend.

If buyers want to prevent a downward move, they will have to swiftly push the price back above 99.57. That could start a recovery to 101.

Bitcoin price analysis

Bitcoin broke above the resistance line on April 12, and the bulls successfully held the retest of the breakout level on April 13.

BTC/USDT daily chart. Source: Cointelegraph/TradingView

The 20-day EMA ($82,979) has flattened out, and the RSI is near the midpoint, suggesting that the selling pressure is reducing. The BTC/USDT pair could climb to $89,000, which is likely to act as a stiff resistance. If the price turns down sharply from $89,000 and breaks below the 20-day EMA, it will indicate a range formation. The pair may oscillate between $89,000 and $73,777 for a few days.

If sellers want to trap the aggressive bulls and retain control, they will have to quickly pull the price back below the 20-day EMA. If they do that, the pair may descend to $78,500 and subsequently to the vital support at $73,777.

Ether price analysis

Ether (ETH) is facing selling at the 20-day EMA ($1,722), as seen from the long wick on the April 14 candlestick.

ETH/USDT daily chart. Source: Cointelegraph/TradingView

If the price plummets below $1,546, the ETH/USDT pair could retest the $1,368 support. This is a crucial level for the bulls to defend because a break below $1,368 could start the next leg of the downtrend toward $1,150.

Conversely, if buyers propel the price above the 20-day EMA, it signals that the bears are losing their grip. There is resistance at the 50-day SMA ($1,955), but it is likely to be crossed. The pair may then ascend to the solid resistance at $2,111.

XRP price analysis

XRP (XRP) turned down from the 50-day SMA ($2.24) on April 13, indicating that sellers are active at higher levels.

XRP/USDT daily chart. Source: Cointelegraph/TradingView

The 20-day EMA ($2.10) has flattened out, and the RSI is near the midpoint, indicating a balance between supply and demand. A break below $2 will tilt the advantage in favor of the bears. The XRP/USDT pair could drop to $1.72 and later to $1.61.

Buyers will gain the upper hand if they push and maintain the price above the 50-day SMA. If they can pull it off, the pair could rally to the resistance line. Sellers are expected to aggressively defend the resistance line because a break above it signals a potential trend change.

BNB price analysis

BNB (BNB) is facing resistance at the downtrend line, but a minor positive is that the bulls have not ceded much ground to the bears.

BNB/USDT daily chart. Source: Cointelegraph/TradingView

That increases the likelihood of a break above the downtrend line. If that happens, the BNB/USDT pair could ascend to $645. Sellers will try to guard the $645 level, but it is likely to be crossed.

This positive view will be invalidated in the near term if the price turns down sharply from the downtrend line and breaks below $566. That could keep the pair stuck inside the triangle for a while longer.

Solana price analysis

Sellers are trying to defend the 50-day SMA ($130) in Solana (SOL), but the bulls have kept up the pressure.

SOL/USDT daily chart. Source: Cointelegraph/TradingView

If the price closes above the 50-day SMA, the SOL/USDT pair could rise to the $147 to $153 resistance zone. Sellers are expected to vigorously defend this zone, but if the bulls prevail, the pair could surge to $180.

The first support on the downside is the 20-day EMA ($123). A bounce off the 20-day EMA will keep the positive momentum intact, while a break below it could sink the pair to $110 and eventually to $95.

Related: Solana rallies 20% against Ethereum, but is $300 SOL price within reach?

Dogecoin price analysis

Buyers are trying to start a recovery in Dogecoin (DOGE) but are expected to face stiff resistance from the bears at the moving averages.

DOGE/USDT daily chart. Source: Cointelegraph/TradingView

If the price turns down from the moving averages, the bears will again attempt to sink the DOGE/USDT pair below $0.14. If they manage to do that, the selling could accelerate, and the pair may slump to $0.10.

Contrarily, if buyers propel the price above the moving averages, the pair could rally to $0.20. This is an important near-term level to watch out for because a break above it will complete a double-bottom pattern. The pair could then climb toward the pattern target of $0.26.

Cardano price analysis

Buyers are struggling to push Cardano (ADA) above the 20-day EMA ($0.65), indicating that demand dries up at higher levels.

ADA/USDT daily chart. Source: Cointelegraph/TradingView

If the price turns down from the 20-day EMA, the next support on the downside is $0.58 and then $0.50. Buyers are expected to fiercely defend the $0.50 level because a break below it could sink the ADA/USDT pair to $0.40.

On the upside, buyers will have to drive and maintain the price above the 50-day SMA ($0.71) to signal that the downtrend could be over. That could propel the pair to $0.83 and subsequently to $1.03.

UNUS SED LEO price analysis

Buyers are trying to push UNUS SED LEO (LEO) above the 20-day EMA ($9.39), but the bears are posing a substantial challenge.

LEO/USD daily chart. Source: Cointelegraph/TradingView

The flattening 20-day EMA and the RSI near the midpoint suggest a balance between supply and demand. That could keep the LEO/USD pair stuck between $9.90 and $8.79 for a few days.

The next trending move could begin on a break above $9.90 or below $8.79. If buyers kick the price above $9.90, the pair will complete a bullish ascending triangle pattern. This bullish setup has a target objective of $12.04.

On the downside, a break below $8.70 could signal the start of a deeper correction toward $8.30.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

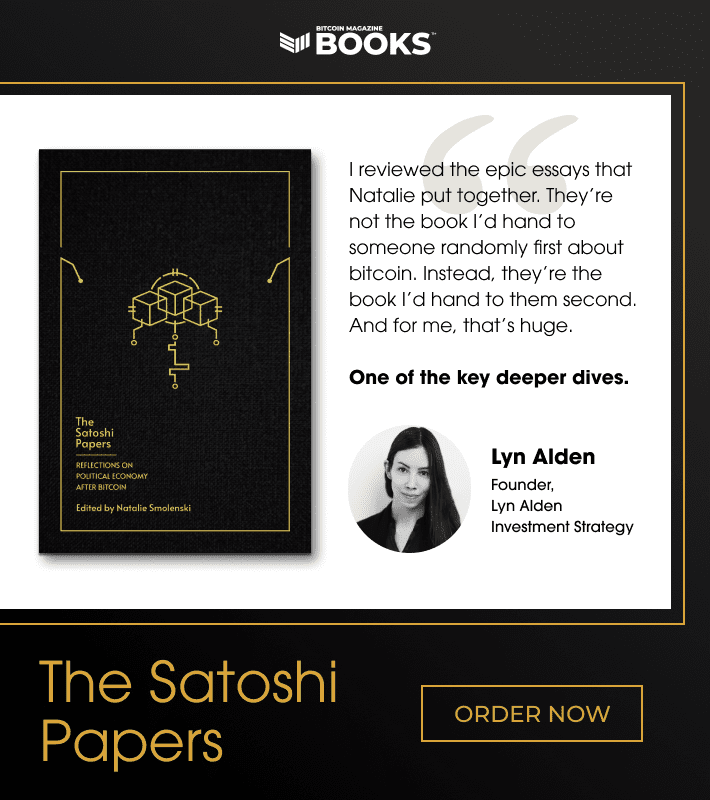

An Excerpt From The Satoshi Papers: The Banker Revolution

In the United States, the twentieth century began with a centralization of power that replaced key elements of the tradition of American liberty with a new interpretation of federal authority. Participants in the 1910 Jekyll Island Conference wrote the Federal Reserve Act, passed into law in 1913, which established the Federal Reserve, the US Central Bank. The Fed was given the dual mandate of keeping inflation low and employment high, and the main tools it had at its disposal were control over the money supply and control over the price of money via the federal funds rate. Before long, the Fed was put to the test when an unprecedented financial crisis in 1929 metastasized into the economic crisis we call the Great Depression. The Fed neither prevented nor ameliorated either crisis, but the conclusion many economists and political leaders drew from this was that the state needed to exert more control over American economic life. The subsequent authoritarian turn in the United States mirrored the trajectories of other countries: When US President Franklin Delano Roosevelt (FDR) issued Executive Order 6102 in 1933, which ordered everyone living in the United States to surrender their gold to the US Treasury and suspended the redeemability of dollars for gold, he was engaging in asset confiscations that mirrored those executed by other authoritarian leaders of the same era, including Winston Churchill, Joseph Stalin, Benito Mussolini, and Adolf Hitler.,

During the First and Second World Wars, countries allied with the United States purchased American-made weapons with gold. This led the US to amass the world’s largest gold stockpile. As the Second World War drew to a close, allied nations met in Bretton Woods, New Hampshire, to determine the outlines of a postwar international monetary order. They decided to establish the US dollar—once again redeemable for gold—as the global reserve currency. The same conference also resulted in the foundation of the International Monetary Fund and World Bank, multinational lending institutions whose mandate was ostensibly to facilitate and balance trade between nations while promoting international development, but whose mixed legacy has included the ensnaring of dozens of poor countries in webs of inescapable debt peonage.

Meanwhile, in the United States, a postwar military-industrial complex emerged that ensured both the normalization of a wartime posture in peacetime and GDP-enhancing arms dealing to allies and others. The routinization of war as a central pillar of American anticommunist foreign policy—beginning with the Korean War and continuing in Vietnam, Laos, Lebanon, Cambodia, Grenada, Libya, Panama, and other countries, not to mention the countless clandestine operations and proxy wars that occurred during this time—had to be funded somehow. This imperative led the Nixon administration to suspend the redeemability of dollars for gold in 1971 and, a few years later, to strike an informal agreement with the government of Saudi Arabia to denominate oil purchases in dollars and recycle those dollars back into the US economy. This petrodollar agreement, although it had the characteristics of a treaty, was concluded entirely in secret by the executive branch, in part to bypass the constitutional requirement that Congress approve all treaties into which the United States enters.

The petrodollar system is now itself unraveling, as major oil producers around the world have begun pricing oil in other currencies. That is a predictable international response to US foreign policy since the end of the Cold War, which has insisted on unipolar American dominance in the conduct of international trade and military operations. The terrorist attacks of September 11, 2001, in particular, became the pretext for the United States to declare an open-ended war on terror and to spend trillions of dollars on foreign wars, to remilitarize or fragment countries that would otherwise have been on trajectories toward greater stability, and, most consequentially, to formally militarize the US homeland via the establishment of a new military command (USNORTHCOM) and new executive department (the Department of Homeland Security).

The militarization of the homeland—anathema to the founders of the United States—has entailed snuffing out the last vestiges of a citizen’s right to privacy in the name of counterterrorism via the AML/KYC of everything. The roots of this development extend to the 1970s, long before the war on terror. Indeed, the 1970s can be seen as the decade in which the Banker Revolution came into full maturity and the American experiment in liberty truly unraveled. The Bank Secrecy Act kicked off the decade with its passage by Congress in 1970. It required US-based financial institutions to keep records of all financial transactions that “have a high degree of usefulness in criminal, tax, and regulatory investigations or proceedings,” as interpreted by the US Treasury, and to share those records with any law enforcement agency upon request. Likewise, financial institutions had to report the transfer of any amount over $5,000 into or out of the United States. The Treasury subsequently promulgated a rule under the legislation that all domestic transactions over $10,000 had to be reported. That reporting threshold has remained unchanged until the present day, despite the fact that even under conservative estimates, the US dollar has lost nearly 90% of its purchasing power since 1970.,

The Bank Secrecy Act represented an unprecedented erosion of the Constitution’s Fourth Amendment protections against warrantless search and seizure. Although it was challenged, the Supreme Court upheld the law in United States v. Miller (1976), which established the third-party doctrine: That Americans have no reasonable expectation of constitutional protections for records held by a third party. This ruling surprised and outraged some, which in turn led Congress to pass the Right to Financial Privacy Act two years later (1978). However, this act carved out twenty substantial exceptions to the right to financial privacy, which ended up weakening privacy protections even further. In the same year, Congress also passed the Foreign Intelligence Surveillance Act (FISA), whose stated purpose was curtailing illegal surveillance practices by federal intelligence and law enforcement agencies in the wake of abuses by the Nixon administration. However, the FISA purported to achieve this by establishing a kangaroo court, the Foreign Intelligence Surveillance Court (FISC), a secret court that issues classified warrants for virtually any surveillance activity requested by the state.,,,

The Bank Secrecy Act (1970), United States v. Miller (1976), the Right to Financial Privacy Act (1978), and the FISA (1978) were the seeds of the full surveillance system of government we have today in the United States. These four legal maneuvers killed American liberty long before personal computers or the internet had any meaningful traction in the world, but they have been used to justify the full collection and sharing of financial-transaction data (and communication data more broadly) that occur via software platforms and digital networks—the virtually inescapable infrastructures of modern life. They have also given rise to, at minimum, eight additional federal laws that have vastly broadened the scope of legal surveillance: The Money Laundering Control Act (1986); the Anti-Drug Abuse Act (1988); the Annunzio-Wiley Anti-Money Laundering Act (1992); the Money Laundering Suppression Act (1994); the Money Laundering and Financial Crimes Strategy Act (1998); the USA PATRIOT Act (2001); the Intelligence Reform and Terrorism Prevention Act (2004); and the FISA Amendments Act (2008), which includes the infamous Section 702 amendment, which authorizes the circumvention even of the Foreign Intelligence Surveillance Court when authorized by the attorney general and the director of national intelligence. Finally, these laws and legal decisions have served as justification for the formation of at least three new intelligence agencies with the mandate to collect and share financial-transaction data worldwide: The Financial Action Task Force (1989), FinCEN (1990), and the US Treasury Office of Intelligence and Analysis (2004).

In short, within a generation, the US banking system, which had been centralized at the beginning of the twentieth century, became an extension of the policing function of the state. The revolving door between Wall Street, the Federal Reserve, and the Treasury—a career circuit in which elites cycle between appointments at these institutions—has only accelerated the flywheel of collusion between those who make and enforce laws and those who control money. This has ensured that the machine first built by the Banker Revolution and then bolstered by the petrodollar system keeps running well for elites via unofficial coordination and official bailouts. The actions taken by nation-states worldwide following the 2008 Great Financial Crisis did not right any of these wrongs. Bankers were bailed out in virtually all countries, save in outliers like Iceland. They were bailed out again, along with much of industry, in 2020 during the COVID-19 pandemic. In the US, these bailouts get sanctioned, renewed, and funded through zero-debate omnibus bills endorsed by leaders of both political parties.

But the 1970s did not just merge banks with the state and usher in the end of financial privacy; the decade also inaugurated rule by state of emergency, a practice in which US presidents declare national emergencies in order to arrogate to themselves powers that would otherwise be prohibited them by the Constitution. In 1976, Congress passed the National Emergencies Act (NEA), which formalized the process by which a president could declare a state of emergency. Although ostensibly intended to limit the president’s emergency powers, the formalization was so procedurally precise and broad in scope that it resulted in presidents declaring national emergencies with much greater frequency. President Jimmy Carter declared the first national emergency under this law in 1979—Executive Order 12170—imposing sanctions on Iran in the wake of the Iranian hostage crisis. To do this, he also relied on the International Emergency Economic Powers Act (IEEPA), a 1977 law that authorizes presidents to freeze the assets of and block transactions with any entity outside of the United States if they decide that it poses an “unusual and extraordinary threat.”

This combination of laws effectively gave US presidents unilateral power to prohibit and punish economic activity by anyone, anywhere in the world, simply by declaring a national emergency. Because transactions in US dollars generally pass through a US-controlled financial network, and because the dollar remains the world’s primary commercial unit of account and sovereign reserve currency, the NEA and IEEPA—domestic US laws—have been used to punish people and organizations otherwise operating outside of US jurisdiction. As a result, the executive branch of the US government—US presidents and the US Treasury Department, the cabinet agency that enforces presidential orders pertaining to financial transactions—extend a form of effective rule over most of the world.

Executive Order 12170 was only the first instance of the United States imposing sanctions on a foreign nation via executive order. Since that time, the executive order has become a routine way for US presidents to bypass the lengthy legislative process to impose sanctions quickly. The International Emergency Economic Powers Act, always invoked in conjunction with the National Emergencies Act, has been used to legitimate nearly seventy separate emergency declarations, amounting to a roster of over fifteen thousand sanctions, and counting., In addition, the US has also used its influence over the United Nations Security Council to pass a host of resolutions imposing multilateral sanctions on specific entities and those associated with them; member states are then obligated to enforce these sanctions under chapter 7 of the UN Charter. UN sanctions are implemented without legal due process, and many of their target entities have never been accused or convicted of a crime. The ease with which sanctions can be imposed and their popularity as a tool of punishment and coercion, which on the surface appears to have few downsides for American politicians, have contributed to their accelerating proliferation. As of this writing, the United States has sanctioned approximately one-third of all countries in the world. The enforcement of these sanctions has become so onerous that the Treasury Department is experiencing record staff turnover and an unmanageable caseload. Another revolving door has emerged: Between the Treasury and private legal, consulting, and lobbying firms, as former Treasury officials leverage their understanding of the byzantine sanctions system and their government connections to secure better political and legal outcomes for their clients.

Perhaps most importantly, however, sanctions appear to have little political effect on the regimes they target. With few exceptions, autocratic regimes remain in place, while democracies subject to sanctions tend to react by spending more on defense, further entrenching existing regime power. The sheer number of countries sanctioned by the United States has incentivized dozens of countries to forge new geopolitical alliances and to build alternative financial systems that can avoid the US-controlled banking system entirely. What sanctions have been shown to achieve, however, is routinized poverty, if not economic collapse, that affects the people of sanctioned countries., This reliably turns the hearts and minds of sanctioned populations against the United States, breeding resentment and enmity for decades. Even so-called smart sanctions, which target specific industries or specific entities, are usually ineffective politically; their limited scope and weak incentives for those in power create insufficient pressure to force the desired change in policy or regime turnover. Moreover, their actual implementation tends to have binary effects on targeted parties: Travel bans and asset freezes can be relatively minor inconveniences for powerful actors who have planned ahead, while arms embargoes and bans on commodity exports from targeted countries create more collateral damage than they purport to. This obviously calls into question whether such sanctions can be called smart in the first place.

There is a perversity to the consolidation of bank-state power since the 1970s: Most of the legislation recounted above was introduced with the ostensible public objective of limiting the power of seemingly unaccountable actors. The Bank Secrecy Act was intended to limit the power of banks. The National Emergencies Act was intended to limit the power of the presidency. And the Foreign Intelligence Surveillance Act was intended to limit the power of federal law enforcement and intelligence agencies. However, all of these attempts produced exactly the opposite of their publicly intended effects because they suffered from a fundamental and fatal error: Seeking to achieve by statute a limit that was already in the framework of the Constitution. By overriding the Constitution with federal law, lawmakers have created a legal, political, and military environment that has returned political assumptions to what they were prior to the American Revolution. The primary political actor is now understood to be the state; individual rights have been reconceptualized as privileges; the individual is now presumed guilty before the law; and the state is now seen as the holder of rights, money, and power, which it deploys imperially and unaccountably. These are symptoms of a political culture in deep crisis.The Satoshi Papers is now available in the Bitcoin Magazine Store – order the paperback today or pre-order the limited Library edition, shipping mid-June 2025.

[6] Franklin D. Roosevelt, “Executive Order 6102—Forbidding the Hoarding of Gold Coin, Gold Bullion and Gold Certificates,” The American Presidency Project, April 5, 1933, https://www.presidency.ucsb.edu/documents/executive-order-6102-forbidding-the-hoarding-gold-coin-gold-bullion-and-gold-certificates.

[7] Elites largely did not lose their gold in this national asset seizure because they had alternative ways of holding the asset through trusts, companies, and custodians.

[8] For the summative historical narrative that follows, see Josh Hendrickson, “The Treasury Standard: Causes and Consequences,” in The Satoshi Papers: Reflections on Political Economy after Bitcoin, edited by Natalie Smolenski (Nashville, TN: Bitcoin Policy Institute, 2024), XX-XX; Michael Hudson, Super Imperialism: The Economic Strategy of American Empire, Third Edition (Dresden: Islet, 2021); and Jamie Martin, The Meddlers: Sovereignty, Empire, and the Birth of Global Economic Governance (Cambridge: Harvard University Press, 2022).

[9] Norbert Michel and Jennifer J. Schulp, “Revising the Bank Secrecy Act to Protect Privacy and Deter Criminals,” Cato Institute, July 26, 2022, https://www.cato.org/policy-analysis/revising-bank-secrecy-act-protect-privacy-deter-criminals.

[10] Aaron O’Neill, “Purchasing power of one US dollar (USD) in every year from 1635 to 2020*”, Statista, July 4, 2024, https://www.statista.com/statistics/1032048/value-us-dollar-since-1640/.

[11] US Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers: Purchasing Power of the Consumer Dollar in U.S. City Average,” FRED, Federal Reserve Bank of St. Louis, October 29, 2024, https://fred.stlouisfed.org/series/CUUR0000SA0R.

[12] Nicholas Anthony, “The Right to Financial Privacy,” Cato Institute, May 2, 2023, https://www.cato.org/policy-analysis/right-financial-privacy#right-financial-privacy-act-1978.

[13] Congressional Research Service, “Foreign Intelligence Surveillance Act (FISA): An Overview,” April 11, 2024, https://sgp.fas.org/crs/intel/IF11451.pdf.