Your cart is currently empty!

5 Stocks Under $10 With Double-Digit Fair Value Upside Potential

- In the dynamic world of investing, finding undervalued gems can lead to significant gains.

- Here, we highlight five stocks, all trading under $10, that not only offer value but also have the potential for double-digit fair value upside.

- According to the AI-powered InvestingPro Fair Value Model, these companies are significantly undervalued, making them compelling buys.

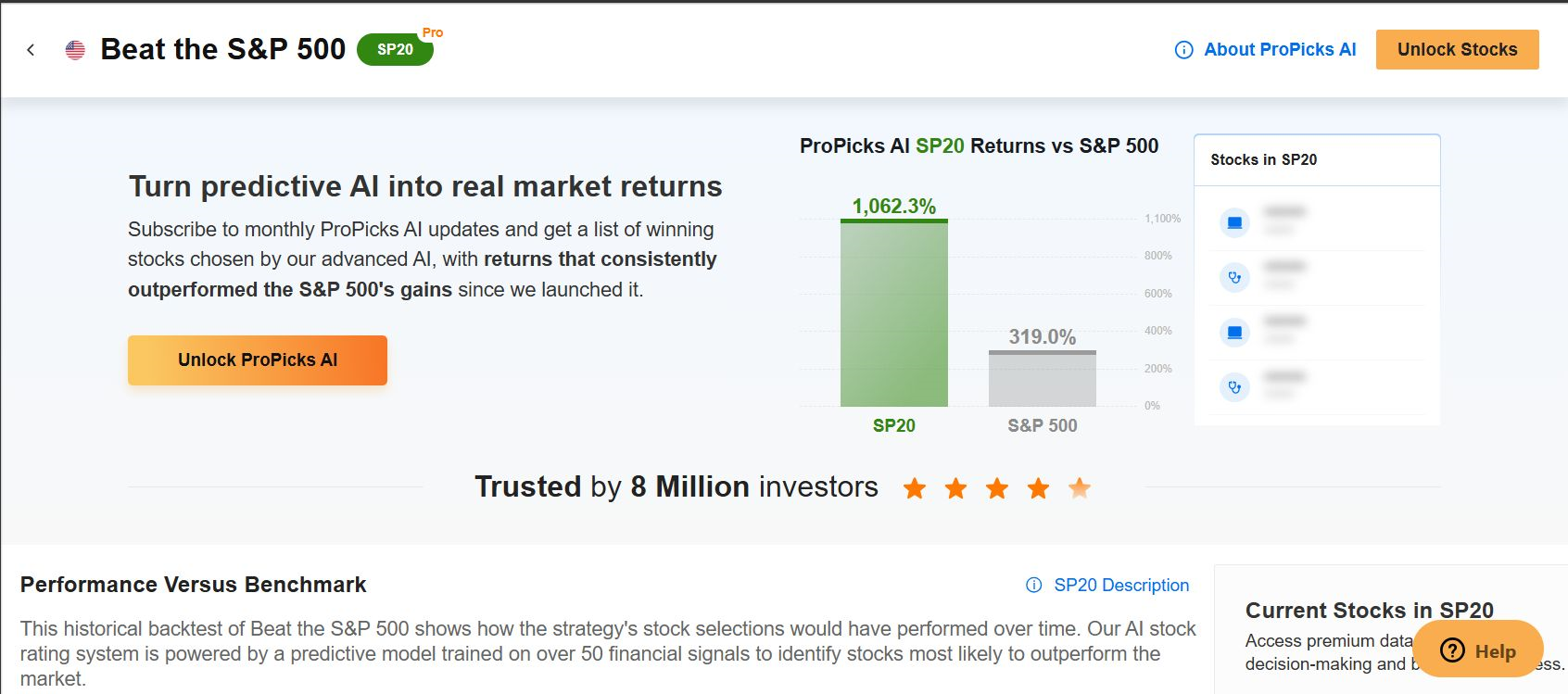

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

In today’s dynamic market, undervalued stocks trading under $10 can offer investors tremendous upside when paired with solid fundamentals and clear growth catalysts.

Leveraging InvestingPro’s AI-powered Fair Value models, we’ve identified five companies that stand out: IHS Holding (NYSE:), Melco Resorts & Entertainment (NASDAQ:), Inter and Co Class A (NASDAQ:), Janus International Group (NYSE:), and Agilon Health (NYSE:).

Each of these stocks is trading at bargain levels and presents significant double-digit upside potential as they capitalize on favorable industry tailwinds.

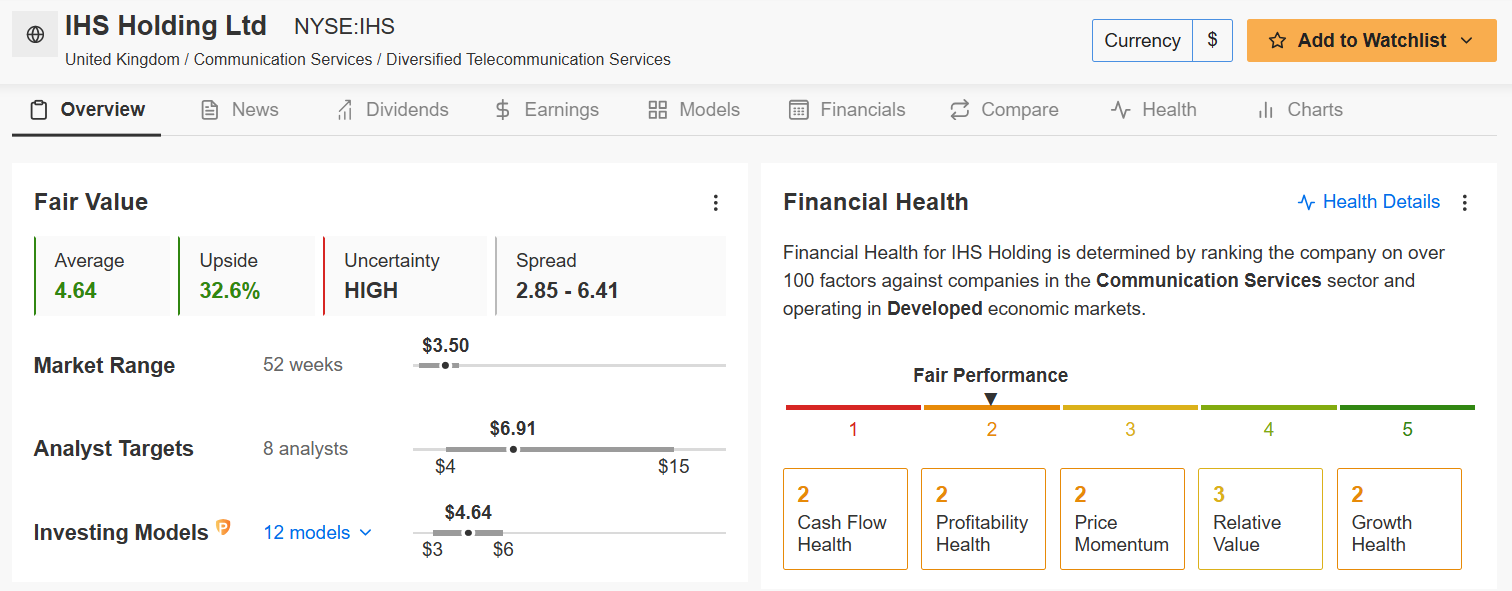

1. IHS Holding

- Current Price: $3.50

- Fair Value Estimate: $4.64 (+32.6% Upside)

- Market Cap: $1.2 Billion

IHS Holding, often referred to in its operational capacity as IHS Towers, is a global giant in the shared communications infrastructure sector. With operations across Africa, Latin America, and the Middle East, IHS specializes in building, operating, and developing vital communication infrastructure in emerging markets.

Source: InvestingPro

The InvestingPro Fair Value model suggests that IHS shares are substantially undervalued, making them an attractive buy at current levels. Trading at $3.50, InvestingPro estimates its fair value at $4.64, indicating a potential upside of +32.6%.

Despite challenging market conditions, IHS sports a ‘FAIR’ Financial Health Score of 2.18. The company’s EBITDA of $966.47M and strong return on invested capital (ROIC) of 10.9% demonstrates operational efficiency.

IHS currently owns and manages an impressive portfolio of over 40,000 towers across 10 countries spanning three continents. This rapid growth trajectory positioned IHS as one of the world’s fastest-growing tower operators.

Source: Investing.com

Shares have been on a tear since the start of 2025, rising by about 20% year-to-date.

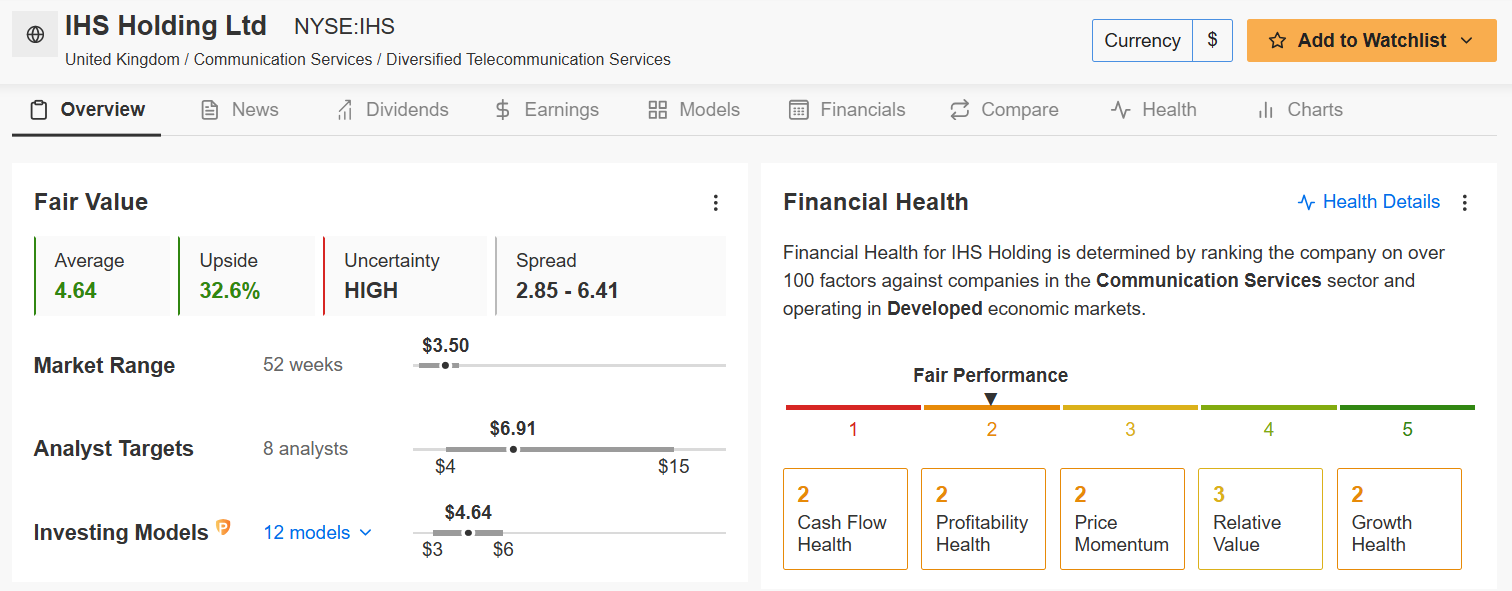

2. Melco Resorts & Entertainment

- Current Price: $5.75

- Fair Value Estimate: $7.58 (+31.9% Upside)

- Market Cap: $2.5 Billion

Melco Resorts & Entertainment is a premier developer, owner, and operator of gaming and entertainment resorts, primarily in Asia. Known for its luxurious properties and integrated leisure experiences, Melco benefits from robust tourism trends and rising consumer spending in key markets.

Source: InvestingPro

Shares of the Macau casino operator currently trade at $5.75 with a ‘FAIR’ Financial Health Score of 2.29. Melco’s return to profitability with positive earnings per share of $0.11 and projected growth in FY2025 signals a strong recovery.

With an InvestingPro Fair Value estimate of $7.58 (+31.9% upside) and analyst targets up to $10.00, Melco’s positioning in the Asian gaming market offers substantial upside potential.

The travel and entertainment company’s strong brand, strategic expansion initiatives, and diversified revenue streams make it a resilient performer.

Source: Investing.com

The shares are just about flat so far in 2025 after a 34% decline in 2024.

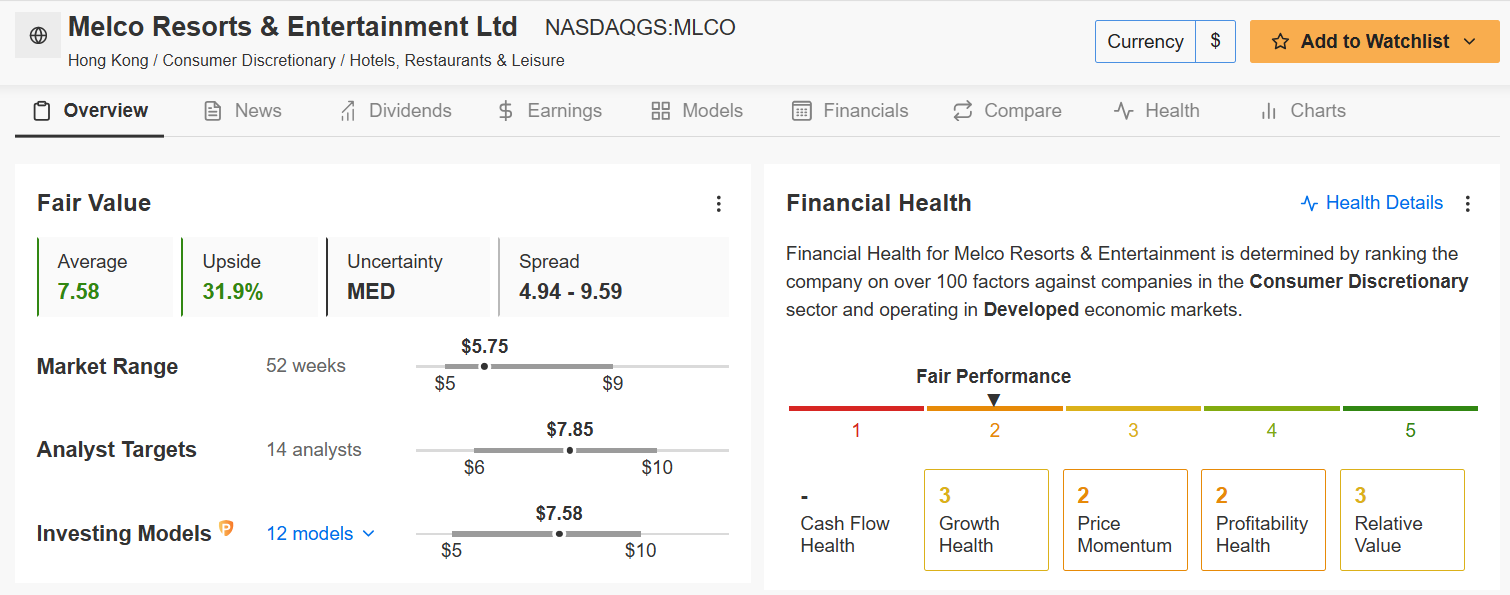

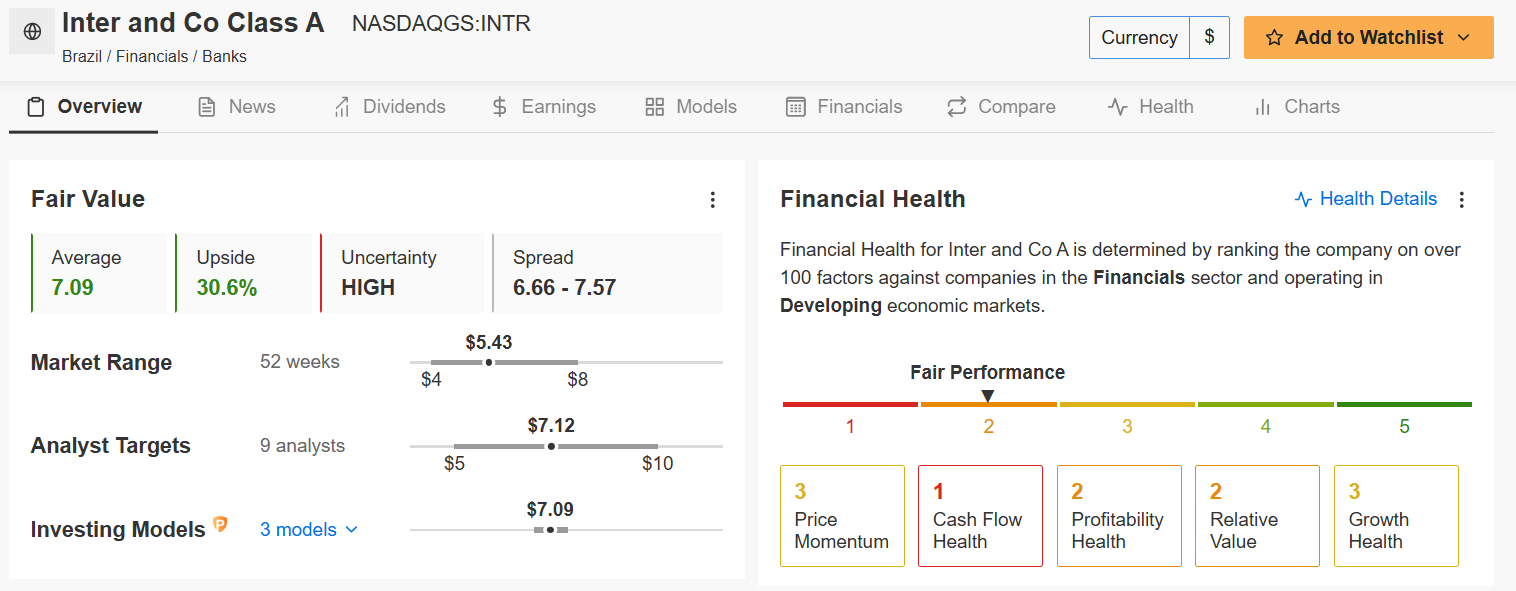

3. Inter & Company

- Current Price: $5.43

- Fair Value Estimate: $7.09 (+30.6% Upside)

- Market Cap: $2.4 Billion

Inter & Co stands out as a pioneering force in the fintech sector, particularly in Brazil and the United States. Founded in 1994, the company evolved from a traditional bank to a leading digital banking platform by 2015. Its innovative super app offers users a comprehensive suite of financial services, including money transfers, bill payments, savings options, investments, and shopping rewards.

Source: InvestingPro

Currently trading at $5.43, INTR demonstrates robust fundamentals with a ‘FAIR’ Financial Health Score of 2.40. The Brazilian financial technology company shows impressive revenue growth of 43.3% in FY2024, with projected growth of 77% for FY2025.

With an InvestingPro Fair Value estimate of $7.09 (+30.6% upside) and analyst targets reaching $10.00, Inter’s strong return on equity (ROE) of 11.1% and moderate price-to-earnings ratio of 14.8x suggest significant growth potential.

The company’s dividend yield of 1.5% adds an attractive income component.

Source: Investing.com

Shares are up by roughly 29% so far in 2025.

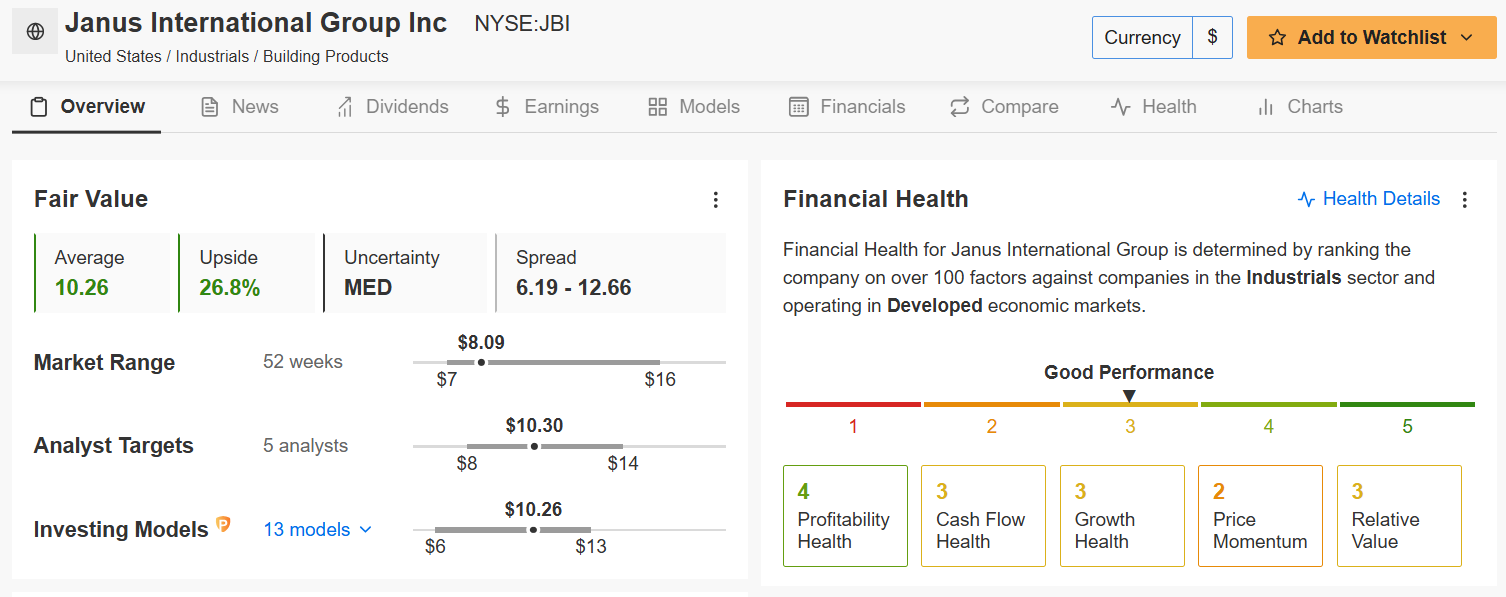

4. Janus International Group

- Current Price: $8.09

- Fair Value Estimate: $10.26 (+26.8% Upside)

- Market Cap: $1.1 Billion

Janus International Group is a global manufacturer and distributor of industrial products serving a wide array of end markets, including automotive, agriculture, and construction. The company’s extensive product portfolio and strong distribution network have helped it achieve consistent revenue growth over the years.

Source: InvestingPro

Currently trading at $8.09, JBI stands out with a ‘GOOD’ Financial Health Score of 2.72. The self-storage solutions provider maintains solid profitability with an impressive 13.6% ROE and 10.6% ROIC.

With a Fair Value estimate of $10.26 (+26.8% upside) and analyst targets reaching $14.00, Janus’s strong market position and operational efficiency make it an attractive value play.

As demand for industrial products continues to rise amid increased infrastructure spending, Janus International Group is well-positioned to thrive on this trend. Its robust fundamentals and diversified exposure to growing end markets make it an appealing pick for investors seeking industrial growth at a bargain price.

Source: Investing.com

Shares are up around 10% since the start of 2025.

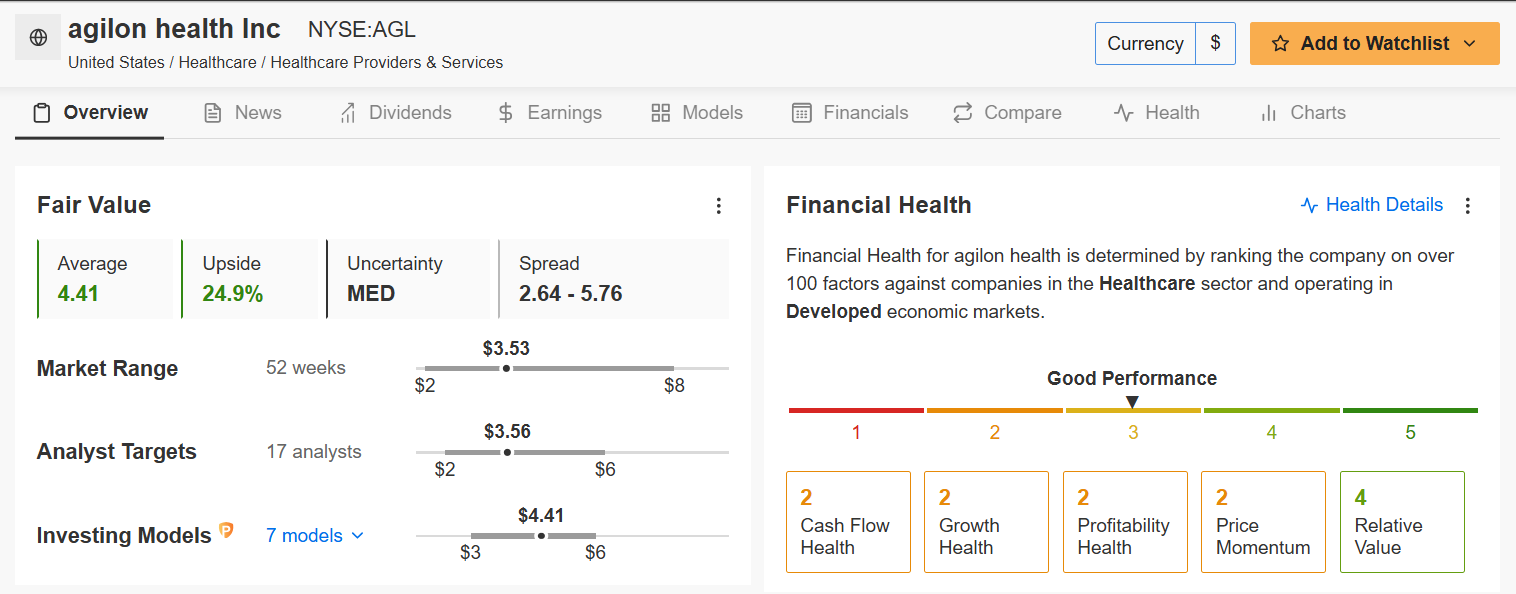

5. Agilon Health

- Current Price: $3.53

- Fair Value Estimate: $4.41 (+24.9% Upside)

- Market Cap: $1.5 Billion

Agilon Health is transforming the delivery of healthcare by partnering with physicians and payers to improve outcomes for Medicare Advantage populations. Amid an aging U.S. population and rising healthcare spending, the company leverages advanced technology and innovative care management practices to drive cost efficiency and enhanced patient care.

Source: InvestingPro

Agilon, trading at $3.53, maintains a ‘FAIR’ Financial Health Score of 2.41. The healthcare company’s impressive revenue growth of 40.4% in FY2024 showcases its expanding market presence.

With a Fair Value estimate of $4.41 (+24.9% upside) and analyst targets reaching $6.00, Agilon’s transformation of primary care delivery presents significant growth opportunities despite current operational losses.

Its strong growth prospects and recurring revenue from long-term healthcare contracts make it a standout defensive play in the healthcare sector.

Source: Investing.com

AGL stock is up a whopping 85.6% through the first three months of 2025.

Conclusion

These five stocks— IHS Holding, Melco Resorts & Entertainment, Inter & Co, Janus International Group, and Agilon Health—offer compelling opportunities for investors willing to look beyond the headlines.

Trading under $10 and supported by InvestingPro’s AI-powered Fair Value models, each of these companies is poised to deliver double-digit upside as they capitalize on strong industry tailwinds.

For those seeking growth at a bargain price in today’s volatile market, these undervalued plays provide both stability and the potential for significant long-term returns.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

Leave a Reply